Those of you who have followed this blog from the start probably know that I’m not shy about recording my mistakes and failings when it comes to miles and points hobby. I think it’s important not to present a skewered picture where everyone is always smiling and vacationing in an overwater bungalow in Maldives/Tahiti. A world where nothing ever goes wrong and everything is always free. Free!

So, here is my latest fail and it’s a big one. Few months ago, I got a TD Cash Visa card in both mine and my husband’s names. It is an odd bank, I must say, and not very user-friendly. But the allure of real cash was very strong because we can sure use it right now. One of the things I didn’t like was the fact that you couldn’t set up Autopay online. You had to fill out a form and mail it in. What is this, 1916?

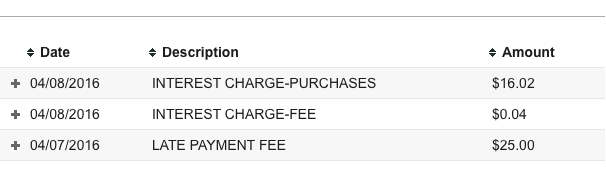

I’m super lazy when it comes to stuff like that, so decided to skip it. I figured I’d manually schedule payments for a few months just so I could collect the bonus. After all, the card isn’t that compelling for everyday spending. Well, look what we have here:

So, what happened? Well, life happened. For one, my parents were visiting last month which brought a lot of stress. Add to it normal everyday activities like spending hours taking kids to two different schools in the opposite parts of the county, picking them up and going to park. School projects, homework, doctor visits, my son’s speech therapy, my daughter’s ballet class, gym. Blah, blah,blah…

Of course, I have to cook, clean, do laundry, shop for groceries and try to spend quality time with my husband. Emphasis on the word “try.” And let’s not forget, on average, I spend 3-4 hours on my blog each day. Why am I blogging again?

I’m sure all of this sounds familiar to you, hobbyists with families, jobs, side businesses and other obligations. Believe me, I’m not writing this to complain but simply pointing out how even keeping track of few credit cards can prove to be a challenge for some of us. Are you saying I should also be doing reselling and learning complex manufactured spending techniques? Are you kidding me?

Of course, some people are very good at multitasking. But I’m not one of them and don’t pretend to be. Just because others are simultaneously participating in 20 schemes doesn’t mean I should join them.

The other day, I was watching Hotels.com commercial that stressed the simplicity of its loyalty program, where you stay 10 paid nights and get 1 free. It then went on to contrast it with schemes prevalent in the miles and points hobby. Take a look at this screenshot of how Hotels.com marketing team views our brethren:

You know what? I don’t think they are that far off, to be honest. It’s a caricature and exaggeration, of course. Still, I think it’s good to now and again look at this hobby from an outsider’s perspective. Most of us enjoy doing math, studying charts and solving puzzles, but it’s easy to go cuckoo for cocoa puffs.

The pursuit of points can easily turn into an unhealthy obsession and take up a huge chunk of your day. It may seem like everyone in the world except you is doing MS and reselling. I assure you, that’s not the case.

Where was I? Ah yes! I could have sworn I paid this credit card bill, alas, I was thinking about my husband’s account. But there is a happy ending. I called and asked TD Bank rep to credit interest charge and late fee as a one-time courtesy. She said that would be fine. A week later the credit still wasn’t there. So I called again and had to beg another rep for the same favor. Finally, I got my $41.

Since payment on the card wasn’t more than 30 days late, it didn’t go on my credit report. Thankfully, I discovered this faux pas in time to fix it, and did get $400 out of the sign-up bonuses on both cards. So all in all: winning! This time around.

If you haven’t seen it, check out this post on Points and Pixie Dust on how just one missed credit card payment almost cost the author mortgage approval on her dream home. It’s a good reminder of how dangerous this hobby really is.

Get organized

1) Simplify,simplify, simplify

I wrote a post on this subject, so won’t repeat myself. You need to look at your daily schedule and cut the fat. And it doesn’t just involve miles and points. Let me give you an example. Most of the things I’ve listed earlier are non-negotiable. I can’t abandon my kids, stop cooking or cleaning.

I also need to go to the gym for my health and sanity. And I need to make time to talk to my husband. But I can post less on this blog and check my emails less frequently. I very much enjoy this little community, but my family comes first. I don’t want to quit this site (not yet), but I do need to set boundaries.

So, look at your life and do the same thing, as in set priorities. Many are encouraging hobbyists to have laser-like focus on latest miles and points earning techniques so they can win the game. No! I don’t want to intensely focus on this hobby. My goal is to focus on my family first and foremost. I want this hobby to revolve around my life, not the other way around.

The other day, my daughter asked me to do something and I forgot it within minutes.

Her: Mommy, but I just asked you this!

Me: Sorry! I have a lot on my mind.

Her: Maybe you should take some of it out.

Out of mouth of babes…

2) Automate, automate, automate

Try to set up automatic payments on all of you credit cards. If it’s not possible, make a habit of paying a bill as soon as you receive it. That way, you’ll never forget it. Also, it could make sense to set up a specific day of the week to check all of you credit card accounts. You can look through charges, make payments, the works.

If there is an option, sign up to receive reminders from the bank when your credit card bill is due.

3) Use free tools to help you.

Mint is a good (and free) tool which I’ve mentioned a few times on my blog. Confession: I haven’t logged into my Mint account for some time. Can you tell?

I hope you learn from my mistakes, and feel free to add your own suggestions on how to stay organized.

Click here to view various credit cards and available sign-up bonuses

Author: Leana

Leana is the founder of Miles For Family. She enjoys beach vacations and visiting her family in Europe. Originally from Belarus, Leana resides in central Florida with her husband and two children.

I did the same thing last month with my Barclay Aaviator that I renewed for the 15k bonus points. It happens to the best of us.

@Shoesinks You are definitely right. It’s very easy to mess up when you are juggling so many cards. I’m trying to get more organized, but it’s a work in progress.

This just happened to me too! We haven’t touched our Barclay card since Alaska and I didn’t even realize I missed the annual fee payment in January! Thank goodness for a Mint alert! And they even waved the late payment charge.

Emily, glad it worked out! This stuff can easily happen to anyone. I need to get back together with Mint. 🙂 One question: Why did you renew your Barclay’s AAdvantage card? Is it for free checked bags? Otherwise, not sure if it’s worth the annual fee if you want it for everyday spending. Of course, YMMV.

It is free checked bags and we still have about 60k miles left to use. Plus the companion certificate.

@Emily Got you! Checked bags benefit can be worth it, for sure. I didn’t think they offered companion certificate anymore. Hmm… Also, you don’t have to have the card open to keep your miles safe. As long as you have activity in your AA account every 18 months, you’ll be fine.