I like to feature questions from readers because chances are, if one person is asking something, there are probably ten others wondering the exact same thing. With that, here is an email I got recently:

“Hi Leana,

In the past I used to apply for 3 cards at a time, or maybe 5 and usually get approved for 2 or 3. I’d use them for our daily purchases and bill paying and whatever minimum spending I had left, I’d top it off with some manufactured spending. Now that resource got very, very complicated, so this is my question for you:

Let’s say I apply for 3 credit cards and I only get approved for one, that’s fine, I’ll probably meet the spending no problem. Now, if I get approved for 3, I won’t be able to. Can I just call and cancel the card that I won’t be able to meet minimum spending on? I realize it would be silly as they would have done a hard pull on my credit, on the other hand, if I don’t use it, I won’t get the bonus so I may be able to re apply in a while? What do you think? I’d hate to only apply for one card for trimester and not get approved for it and miss the chance of getting a bonus.”

This is a very interesting question, but before I answer, let me explain what this reader is talking about. The goal here is to apply for several cards at the same time (literally, the same second), so all the banks see only previous hard pulls done before the day of the application spree. Basically, you open three tabs or use several computers and click “Apply” on all them.

It sounds logical in theory, however, it’s somewhat unlikely that all credit pulls will register the same second because one application could take a bit longer than the previous one. They show up instantly on your credit report and chances are, the second or third bank will see your previous pull (s). Additionally, this strategy may end up being pointless anyway. Those three banks might be pulling three different agencies. Instead of using this method, here is what I suggest you do instead:

1) Pick offers with minimum spending requirements you can comfortably handle

If you do decide to apply for several cards simultaneously, operate under the assumption that you will be approved for all of them. No reason to have extra dings on your credit report for offers you won’t be taking advantage of. Those credit pulls might cost you a lucrative opportunity down the road, so choose wisely.

2) Check Credit Pulls Database

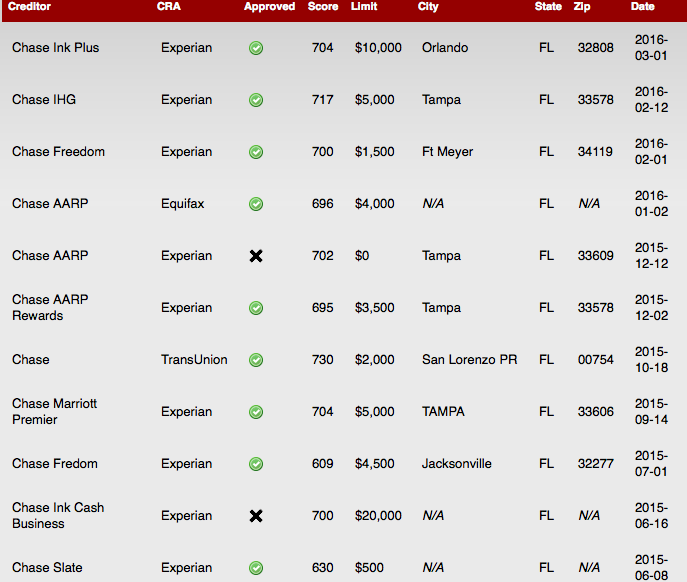

You can do that here Put in a creditor’s name (Chase, Citi etc.), then your state, and see what comes up. If they pull different agencies, then no need to apply at the same time because it won’t matter anyway. For example, let’s say I live in Florida and want to get a Chase card:

Here is what comes up in search:

I think it’s safe to assume that Chase will probably pull Experian. Be aware, some banks use two agencies for certain individuals. Chase actually has been pulling Equifax and Experian for my husband and I over the last few years. I don’t know why and can only assume it’s because we have a lot of credit card applications. I guess they want to double check the report to make sure there is no incriminating evidence. Capital One is known to pull all three bureaus.

3) Apply first for the card you want the most

I’ve mentioned before that I don’t follow any particular schedule and simply apply for new offer when I’m done collecting sign-up bonus for the current one. See my post Why I don’t follow 91-day churn schedule

I recommend you give preference to an offer that you will definitely need in a near future unless there is a spectacular bonus that comes once in a blue moon. No, 75,000 Hilton points ain’t it. It will probably be back. I’m talking something along the lines of 75,000 points offer on Amex Premier Rewards Gold that doesn’t require $10K in minimum spending.

4) Think creatively if you have a hard time meeting minimum spending requirements

Let’s say you’ve already applied for several cards and lo and behold, all got approved! With M/S game going by the way of dinosaurs, you are now in a panic as to how you’ll be able to meet the spending requirements. Fear not! I wrote a post with some ideas on how to do just that. In fact, I will have to use it myself.

I’ve actually applied for Southwest credit card in both mine and my husband’s names. To my shock and disbelief, both got approved. Read this post on upcoming restrictions on Chase co-branded cards and why I did what I did. So, that’s $4K to spend in 3 months. Add my new Citi Advantage card to the mix ($3K in 3 months) and Houston, we have a problem. Oh, did I mention that I’m still working on my TD Cash Visa?

So, I’ll probably have to prepay about $2K in expenses. I don’t do M/S for many reasons, so will have to follow my own advice from that post. Few things I plan on doing: prepaying power bill, buying some Walmart and dining gift cards and asking to pay my in-laws’ bills when it comes to large purchases. While I would never suggest someone does what I just did, I have no regrets.

This might be my last chance to get a sign-up bonus on Southwest credit card. We’ll collect around 104,000 Rapid Rewards points, good for $1,600 in airfare on Southwest or $1,040 in Amazon gift cards. All of this for $198 in annual fees and tying up my savings for a month or so. Not too shabby. Sometimes I don’t mind going outside of my comfort zone for lucrative payout.

I’m an extremely conservative person when it comes to finances. I don’t gamble, I don’t buy individual stocks and my retirement account is split 50/50 between stocks and bonds. But in this particular case, the only gamble involved is whether I go into debt due to this high amount in spending. I’m fairly disciplined, so I’ll take my chances. But it doesn’t mean you should.

Author: Leana

Leana is the founder of Miles For Family. She enjoys beach vacations and visiting her family in Europe. Originally from Belarus, Leana resides in central Florida with her husband and two children.

Leave a Reply