Few weeks ago I wrote a post on Netspend account and why you should consider getting one yourself. I won’t repeat all the reasons why it’s such a good fit for an emergency fund, but want to provide an update. It’s definitely long overdue, but there is a good reason for that: I encountered some roadblocks. So, we got Netspend cards for both me and my husband. When I tried to activate them online, there was a message saying that I needed to call and that the accounts (both of them) were locked. Great.

I’ve mentioned many times how much my husband loves making phone calls. #Sarcasm But it had to be done, so I started with my own account. I must have spent one hour on the phone and got transferred to two different reps. And after all of that, I was told that they couldn’t verify my identity and that I needed to mail in a copy of my driver’s license, power bill and social security card. Are you kidding me? I don’t know if this is what caused the problem, but the first name on my social security card doesn’t match the one I put on my application. It’s normally not a problem, but it looks like this time my account got flagged as a result.

Obviously, I want to get 5% return on $5,000, but is it worth potential identity theft? Then of course, came the dilemma on what to do with my husband’s account. I certainly didn’t want him to spend 1 hour on the phone and be told the same thing. Still, I asked him and he did call… two weeks later. He was able to verify his identity over the phone and the account was activated without an issue. Victory! Interestingly, when I logged in, I saw an option to open the savings account without the initial $500 ACH transfer.

If you read my previous post and followed the link to DoC, you probably saw that this used to be one of the requirements. Chuck ( the author of the post on Netspend) actually mentioned this to me and asked me to test it out, but at the time our accounts were locked and I wasn’t able to. Anyway, I clicked on “Savings” and successfully opened the account.

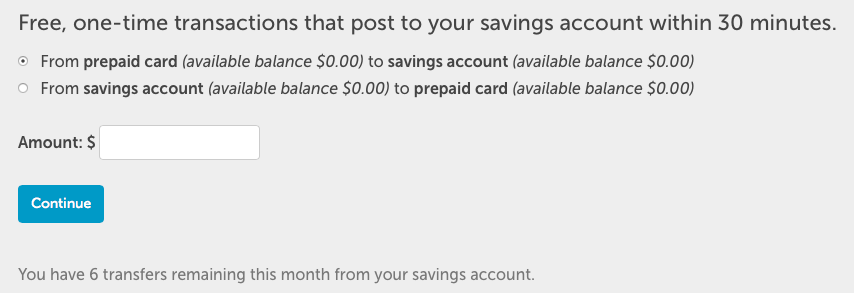

This was the whole point of going through the Netspend rigamarole. Of course, free $20 is nice too. Now I just need to wire $5,000 from my main checking account into prepaid online Netspend card, and from there transfer the whole amount to savings so I can start earning my sweet 5% return. Oh, and it is FDIC insured, in case you are wondering.

This was the whole point of going through the Netspend rigamarole. Of course, free $20 is nice too. Now I just need to wire $5,000 from my main checking account into prepaid online Netspend card, and from there transfer the whole amount to savings so I can start earning my sweet 5% return. Oh, and it is FDIC insured, in case you are wondering.

Note that DoC reports that in order to open Netspend Premier account (which was the original requirement) you will need to have an actual direct deposit as of January 22nd. So, perhaps, this window of opportunity will close soon. Obviously, I’m not saying: Limited time offer! Get it now! Ends soon! I honestly don’t know if that’s the case. But it definitely appears to be an easy option to stash some money at an excellent rate, plus get $20. All you have to do now is sign up for Netspend account, and 5% annual return on savings is yours. For how long this will be available, I have no idea.

If you are looking to sign up, here is my husband’s referral link. Don’t worry, I’ll get the money in the end. Chuck insisted I include my own referral link from now on, but feel free to go to my previous Netspend post (where I included his link) if you want to support him instead. Edit: Please, see my comment section with a link to a post where readers are offering a payout for using their referral.

Remember, you have to transfer $40 in order to get $20 bonus, but the real payoff is getting 5% interest rate on an insured savings account. This isn’t a CD, so there is no penalty for withdrawing the money, and it looks like you can do 6 transfers per month. Get in while it lasts, but be prepared for potential headache. I’m still debating on whether to fax or mail in my documents. Decisions, decisions…

At least one of my readers was able to get everything set up online without any issues, so this is definitely a case of YMMV Something else I wanted to mention is that I had to put my in-laws’ address on my husband’s application to begin with, but was able to update it over the phone without a problem. It wouldn’t otherwise let us get two separate accounts while going through online process, but it’s not against the rules to have one in each name. Also, I was able to add myself to his profile, so my husband doesn’t have to call in case an issue comes up in the future. I’m sure he doesn’t mind one bit.

Readers, please, share your experience with Netspend. Any issues you encountered?

P.S. Just a reminder, I’ve noticed that some readers signed up for Thredup account via my link. Folks, go shopping, you got free $20. Do it now! Ends soon!

Click here to view various credit cards and available sign-up bonuses

Author: Leana

Leana is the founder of Miles For Family. She enjoys beach vacations and visiting her family in Europe. Originally from Belarus, Leana resides in central Florida with her husband and two children.

@Danny Thanks for letting me know. Will update the post. I don’t force anyone to use my link and actually referred readers to Chuck’s link in my previous write-up. My content is free, and in fact, I made exactly zero dollars in the last 30 days in spite of putting in a ton of hours into this site. I try my best to help readers. I do appreciate your comment, though, so please, feel free to stop by any time.

Doc’s link also has comments where people are paying additional amounts for referrals: http://www.doctorofcredit.com/netspend-20-referral-thread-and-details

@Danny, Not trying to start a fight here, but it’s not really polite to post a link to a competitor’s referral here on Leana’s blog. She wrote the post and deserves the referral. I also might add you can tell the kind of person she is because she allowed your comment to post and also thanked you for potentially taking her bonus away and sending it to someone else.