One or more of these credit card offers may no longer be available. See our Hot Deals page for the latest offers.

I wanted to give you a quick reminder on this deal and why you should definitely consider it, especially if you happen to have Citi Prestige or plan to apply for one in a near future. Few days ago, I went ahead and pulled the trigger and opened CitiGold checking account in both mine and my husband’s names. But before I go any further, here is an excellent post on Doctor of Credit with instructions on how to do it and things to watch out for.

Of course, the main appeal of this deal is the fact that you can collect 50,000 Citi Thank You points (or 50,000 AAdvantage miles) without a hard pull on your credit. In order to get the first one, you have to have a card that participates in Thank You program, such as Citi Prestige, Premier or Preferred. In order to qualify for AAdvantage deal, you need to have, you guessed it, an AA mile-earning card.

Be aware, the language in the offer says that it’s only available to those who were targeted. That made me feel a bit uneasy, so I decided to apply over the phone and mention that I saw the offer on the internet (100% true). The agent I spoke with told me that I needed to call a different department but said that as long as I have the code, it should be fine and that I could do it online. Sounds good to me! I did just that.

So, let me describe my experience so far. Keep in mind, I haven’t actually gotten the bonus yet. So, when you head on over to the referenced DoC post, there will be a link to apply. Make sure you put in the code for the offer you choose and select “CitiGold” option (very important). Follow all the steps but don’t fund the account right away because it will probably give you an error (just leave it at zero for now). You do have an option of funding with a credit card but I didn’t do it. Read this post on PointCentric for his experience on using Barclaycard Arrival Plus (edit:It was actually Citi Prestige, but the same principle applies).

I’m very conservative and don’t like to draw attention to myself (aka I’m chicken and proud of it!) If you decide to use your regular checking account to fund it like I did, you will need to link it to Citi first.

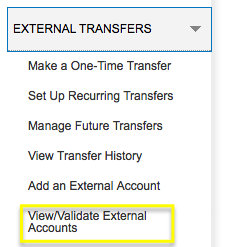

Citi will then make two small deposits into your external account over the next few days and you will need to validate them.

Go to this page, verify the deposits and you are good to go. Transfer some money to CitiGold account. I deposited $150 so I would have a buffer for fees (more on that later). If you are doing Thank You promo, you will have to pay a bill during two consecutive months. You can add your credit card account as long as it’s not Citi.

I added my Chase card and scheduled two $25 payments in order to satisfy the requirements. Voila! That’s it. Well, as long as Citi follows through. That’s why I first sent them a secure message to confirm my eligibility for this bonus. Here is the edited response:

As you can see, there is a monthly fee of $30, and there is no way around it. It looks like I will end up paying it a few times because I sure don’t have $50K lying around. But that’s OK because the bonus is still worth it. Once again, it’s important to look at the big picture. At the very least, I can cash it out for $500 in Walmart gift cards. If you have a Citi Thank You Premier or Citi Prestige, you can combine the points and get greater value when redeemed for flights or travel. Reportedly, points earned from Citi checking account do not transfer to airline miles or hotel points. Let me know in the comments if this has changed.

Another nice perk of having a Citi Gold account is that it qualifies you for $100 discount on your Citi Prestige annual fee, though it’s supposed to be prorated. An odd thing has happened, though. I got a $262 credit instead. I’ve heard of people getting the entire fee refunded depending on when they applied for Citi Prestige (I got mine in May). I’m not sure if I will get a prorated charge added later on, so stay tuned.

So, as you can see, by all accounts, Citi Gold promo is worth considering. Of course, the biggest unknown is whether Citi will honor the deal in the end, but I’m fairly confident that it will since I got a confirmation email from their CSR. You have till 12/31/2015 to apply so don’t delay. Make sure you read the post on DoC as well as comments and follow all the instructions to the letter. This is a good one and worth the risk IMO.

Readers, who applied for this offer? What was your experience?

Click here to view various credit cards and available sign-up bonuses

Author: Leana

Leana is the founder of Miles For Family. She enjoys beach vacations and visiting her family in Europe. Originally from Belarus, Leana resides in central Florida with her husband and two children.

I have also applied for this one. I applied on October 7th, so it’s been a comfortable 3 months. No miles yet. I do not remember using any code as you mention, yikes! But I may have. I read about it on another blog, and they may have mentioned that? I’ll double check, I hope so. To tell you the truth it’s been a lot of work. I had to spend at leas an hour on the phone with them, I had trouble downloading the app to make the deposits, etc. I have already asked if I was entitled to that bonus twice and both times they said yes. The last time I asked because I haven’t seen it yet and the lady said I had already fulfilled the requirements and that it may take up to 90 days to show. Even if I pay $90 for this, 50K American miles are worth that, but again, so much work!! I agree with Black Cheap Dad, I am interested in learning more about bank accounts bonuses, especially after the manufactured spend blow but right now I have to much going on, in my case in terms of cards and accounts so I’ll take it easy. In a few months and after I see if new MS avenues open up, I may hit hard the checking account bonuses.

@Leticia I definitely can relate to what you are saying. Checking account bonuses involve a bit of a hassle, no question. That’s why I don’t pursue them a whole lot, unless they are extremely lucrative. This one is, but as you correctly pointed out, it involves headache, not to mention, dealing with Citi. If they confirmed your bonus eligibility, you should be fine. I would call again in a few weeks, also try secure message in your CitiGold account. You have to be persistent. But yeah, 50K miles is a nice incentive, for sure. Hopefully, you’ll make a nice profit in the end. Let me know how it goes for you.

If you also have the Citi Prestige card be careful this just happened to me: I applied for the Citi Presitge card in June 2015 paid the $450 annual fee fully expecting to cancel the card in June 2016 when the annual fee post. I signed up for the Citi Gold checking account in Dec. 2015 to get the bonus 50K AA miles and now I am being billed the Citi Prestige annual fee in Jan 2016. I called Citi and they said since I signed up for the Citi Gold checking account I will now be billed in Jan of each year! They said there is nothing they could do. Now this is going to force me to cancel the card after only having it for 6 months because I am not paying the annual fee again after only 6 months! Any suggestions?

@Rich That’s weird. I’ve never heard of it, to be honest. Will have to do some research. In the mean time, you may want to consider buying $250 airline gift card, waiting for reimbursement and then canceling Prestige. Of course, make sure to transfer or use up the points. You do have 30 days to get the refund of your fee from the date the Citi card statement is generated.

It is odd. I got a partial refund of my Prestige fee. I wonder if I will be billed again as well? Let me do a post on it tomorrow and ask for some feedback from readers. Thanks!

@Rich Just called Citi. You are correct, they will be billing me for $350. Well, the good news is, like I said, I got the pro-rated refund already. Also, Citi usually pro-rates annual fees. So, what I’m going to do is wait for bonus on CitiGold to post, then cancel the card. It should give me most of that $350 back. I assume that you have to have Citi Prestige open for checking account bonus to post. Will do some research on that.

@Rich Quick question for you. Chuck at DoC is wondering if you got a partial refund on Prestige?

Yes, I did receive a partial refund for $262 in Dec. So, I paid $450 annual fee. I used the $250 airline credit for 2015, I received a $262 credit in Dec, and now I just bought an airline ticket to trigger the $250 airline credit for 2016. I will transfer the remaining 14K Citi Prestige points I have left to my Citi Premier Card wait for my next statement to close in Feb. to receive the $250 airline credit for 2016 then the next day I will cancel the card. Citi rep told me you have 37 days from the time the annual fee post to receive 100% back ($350 fee) after that it is a partial refund.

@Rich Thanks! I’ve updated the new post.

The first two months are supposed to be free. I have just had it a month and no fee.

@HML Thank you so much for your data point! I saw conflicting info on this, but it’s good to know that you get two months without fees.

Thanks for the info. I’m trying to decide if I should do this or not. The thing I’m worried about is the accumulation of the monthly fees–looks like it takes two months for the direct deposits and 3 months after that for the bonus to post, so potentially 5 months of fees for $150 charge for each account? But I guess it would be $1000 worth of rewards for two people, so still $700 profit.

I go with my gut on these. I will eventually be a more active participant in the bank account bonuses but I’m trying to wrap up a few family/professional/personal transitions before playing more in this part of the hobby. Do what you can handle comfortably. This is all gravy on top of our lives. Sometimes it’s empty calories.

But seriously, why say no to $700 if you could pull it off? Again, go with your gut.

@Cheapblackdad Hey, I was typing my reply before I saw your comment! I concur with what you said here: Do what you are comfortable with. Deals come and go, and this one will probably come back at some point. I decided to pull the trigger because I can use some Walmart gift cards. My goal right now is to save cash, and this promo seems like too good of a deal. Emphasis on “seems.”

Shoesinks, your logic is sound. Yes, there is a chance that there will be $150 in fees. But like you said, you will still make $350 profit or more if you redeem points for travel with your Premier card. I plan on calling after the second month to try to speed up the process. With Citi you just never know, and they may try to weasel out of the bonus. I have seen enough data from others to convince me that I have a decent shot at getting the points. And I even got the emails confirming mine and my husband’s eligibility. Plus, there is no hard pull, which is important to me.

For those with Citi Prestige (like me), an extra incentive is a discount on the annual fee. If you are thinking about applying for Prestige in a near future, it should probably sway you towards going for this Citigold promo. I’ve written about Prestige bonus quite a few times, but feel free to email me with questions. Ultimately, though, the choice is yours. I would hate to make definitive statements because there is some uncertainty with this deal.

Did you open up one account in both of your names, or one account for each of you (i.e. two bonuses?)

Nancy, I opened one account for each of us so hopefully, we’ll get two bonuses. Sorry for any confusion! I didn’t see any “one per household” wording but you never know with these things. See this page for terms on Thank You offer https://online.citi.com/JRSAO/ao_online/editAccountSummaryPromoPopup.do?PromoCode=42ERCZ42PY

As I’ve said in the post, there is a bit of risk involved. Plus it’s Citi bank which is an odd beast, to put it mildly. But I do believe the offer is lucrative enough that I’m willing to take a chance. If you do go for it, definitely message them right away and see if they can confirm that the account qualifies for bonus. Otherwise, you might be paying $30 monthly fee for nothing. Fee free to email me or comment if you have any further concerns.