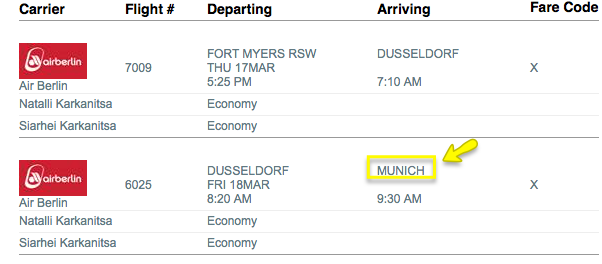

No worries, this is not a dig at American education system. I’m talking about American Airlines loyalty program. So, earlier this year I redeemed miles for my parents’ visit to US. Outbound flights were booked via United program, and inbound via AAdvantage. Of course, a lot can change in one year. And so it did. Here is the info on Air Berlin flights I reserved back in April (via AA program):

And here is the email I got yesterday which contained change in schedule:

Hmm, notice anything peculiar? Apparently, AA reservation system thinks Munich is a good substitute for Moscow. Well, it is located in Europe, I suppose. Right away, I had a bad feeling which was confirmed after I called AAdvantage. The schedule changed and there was no way to reroute the flight. The agent really went out of her way to help. She tried every possible combination, different dates, airports etc. Nada.

Curse you, Brits!

Once again, not the actual British people. The biggest problem was British Airways, American Oneworld partner. As most seasoned hobbyists know, that airline adds obscene fuel surcharges on award tickets when they cross the pond. Even routes within Europe can add significant fees, but if you want to take a transatlantic BA flight, #Forgetaboutit!

I honestly think that’s what turns people off when it comes to loyalty programs, and for a good reason. Charging $600 in taxes on a free ticket is criminal. Seriously, airlines, cut it out! Nevertheless, there was nothing that could be done. It’s their program and they can run it the way they please. So I ended up canceling the tickets and getting miles re-deposited (and getting a refund of taxes I paid).

AAdvantage has lost its luster for me, especially in view of upcoming chart changes (read this post on Travelisfree for unique insights). Award availability has also been drying up, a big downside for family. I’m looking forward to burning my stash and won’t be in a hurry to speculatively accumulate more AA miles. I totally regret buying 50K miles back in the day and getting swept up in hysteria of “free” (not) travel. What can I say? Yours truly isn’t immune to peer pressure. I just might end up burning my AA miles on hotels, like Kenny from Miles4More does on a regular basis. End rant.

The dilemma

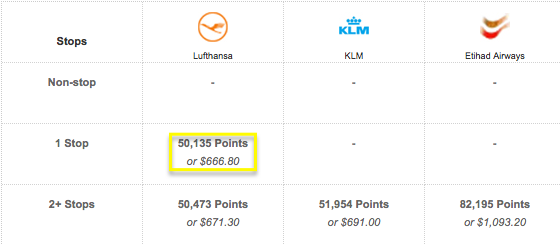

So, what to do? I already redeemed United miles for 2 one-way tickets on Lufthansa and had 60K Ultimate Rewards points which could be transferred to Mileage Plus instantly 1:1. I even found availability for the dates we needed. My sister-in-law has 58.5K miles (intended for my usage), so I was also considering transferring my dormant 1,500 miles at a cost of $43 to top it off. That way, I would keep my flexible and highly valuable UR stash intact. On a whim, I decided to check what the paid price would be for the same route and dates. I logged in to my Citi Thank You account which pulls the same data as sites like Expedia.

I’ll be darned. Since I have Citi Prestige, I get 33% bonus toward flight redemptions on any airline. So, 50K points would take care of the roundtrip flight, including taxes, and the tickets would even earn miles ( a minor benefit). Southwest is not listed, but you can call and redeem the points over the phone.

To beg or not to beg?

So, now I had a dilemma on my hands. I could just go ahead and redeem 30K United miles +$47 tax per person, plus $43 total to top off the account. Or I could call United and beg them to waive or reduce the re-deposit fee for 60K miles I have already redeemed. It normally runs at $200 per person, and in the past I was successful at getting it down to $100 per person. Are you keeping up? Because my head was spinning like crazy few days ago. Not to mention, I was sick as a dog and had a hard time focusing on math aspect of it all. Still, I decided to call United and at least try.

I told the agent that our AA flight schedule had changed and I had to re-book everything. I said upfront that I knew I wasn’t entitled to fee waiver and was simply asking for a courtesy on her part. I could tell it immediately put her at ease. The worst thing you can do in a circumstance like that is be a demanding jerk. It doesn’t matter that the fee is ridiculous (which it is). If the airline is in the right and there hasn’t been a significant schedule change, they hold all the cards. It’s up to you to get them to see your side.

She put me on hold so she could talk to her supervisor. After about 5 minutes she came back and said that they would waive the fees, but keep the taxes of $157. Fair enough, $157 is better than $400. Obviously, I would have preferred to have $0 penalty, but you take what you can get.

Cookoo for miles

I logged in to my United account, but the miles weren’t there. I was refreshing for 20 minutes or so, and nothing. Huh? I went ahead and called United and while on hold, decided to check my husband’s account. Sure enough, I booked with his miles and just forgot. The stash was back in its place. Do you see how one can go cookoo for cocoa puffs after doing this hobby for years?

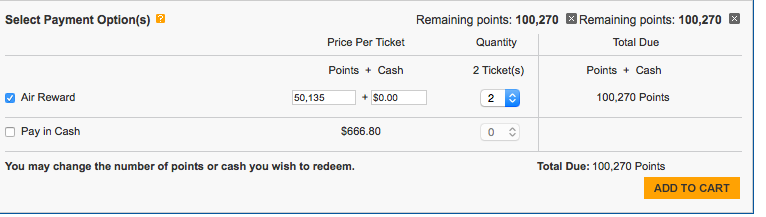

Ok, all set with United. I went back to my Citi Prestige Thank You account. This is what I needed for two tickets:

As you can see, you can use combination of cash and points, a nice perk. I had 54K points, so went ahead and transferred the needed amount from my husband’s account:

The transfer went through instantly. I used some points from Premier card and the remainder from Prestige. After that, I booked the tickets for the dates I needed. To recap: my total cost ended up being 100,270 Thank You points+$157 I lost. If I went ahead with redeeming miles for 2 one-way tickets, I would have spent a total of 120K United miles+$294 (total taxes and miles transfer fee).

I think I did OK all things considered, and we got the exact flights we wanted. One of the issues with Air Berlin was the fact that my parents would have to take an additional flight to Minsk. While the cost is cheap at only $65 per person, my mom absolutely hates flying. She only does it for grandkids. So, overall, even though I’ve lost some money, I’m trying to focus on the big picture. I absolutely plan to use United miles in 6 months or so. Citi Thank You points were obtained via sign-up bonuses and allowed us to keep our savings intact. #Winning

The lessons

1) Always check the cash price before redeeming miles. I didn’t because I just assumed it would run at over $1,000 like it usually does. Belarus currency has devalued significantly in the last few years. It’s a first cousin of Zimbabwean dollar, no joke. I assume the ticket price is set in rubles, which is why it’s quite reasonable at the moment, all things considered.

While redeeming UR points on paid flights isn’t covered in the blogs too often, the truth is, you can often do better going that route rather than transfer to mileage program. You get 1.25 cents per point, so if there is an amazing sale on flights, consider doing that instead.

3) Don’t underestimate Citi Thank You program. It has recently evolved into a mighty competitor to UR and MR programs. If you have Citi Prestige, you get a 33% bonus on all flights, and 60% bonus on American and codeshare routes. If you mostly fly in economy, it will be very hard for you to beat this CPM, unless you are flying to Alaska or Hawaii (see this post). And in those cases, you have Singapore and Air France programs at your disposal.

Plus, if you happen to have Citi Premier as well, you can combine the points and get 25% bonus on all travel redemptions like cruises, hotels and car rentals. Read more on both cards here I admit, if you offered me UR point or Citi Thank You point, I would pick the first one any day of the week and twice on Sunday. That said, Chase is cutting off churners and Citi seems to welcome them with open arms…for now.

4) Wait to book your positioning flights. If you are in a similar situation and need to fill in the gap because mileage redemption to your city isn’t available, hold off on booking any non-refundable tickets. Schedules can change significantly as was the case here. Thankfully, I thought about this scenario and didn’t book any flights from Moscow to Minsk. Phew! I did something right, high five to myself. Of course, if you are redeeming Southwest points, it’s OK to burn those. You can always cancel and re-deposit for free. Otherwise, sit tight.

You can also consider getting insurance that includes “cancel for any reason” option. It should cover re-deposit and cancellation fees. You would have to get it within 14-21 days after your first payment, so don’t delay. Some programs will cover award tickets, others won’t. Get something in writing as your proof. Check Insuremytrip for a quote.

5) Before paying re-deposit penalty in any airline program, call and ask nicely for them to waive it. No, it isn’t fun, and I don’t particularly enjoy doing it. But as long as you are polite and truthful, I find that agents are willing to help or at least meet you half way. You won’t know unless you ask. You may still have to pay something like I did, but it might be a reduced amount.

6) Don’t put all your eggs (aka miles) in one basket. Of course, you shouldn’t collect every currency under the sun, but try to have several airline alliances covered. Ideally, you want to focus your energy on flexible points that transfer to several programs. If Southwest serves your city and you absolutely have to fly domestically, it’s a good program to invest in.

7) Focus on the big picture. Yes, things didn’t go 100% perfectly, but my parents’ visit is all set. I think…

Click here to view various credit cards and available sign-up bonuses

Author: Leana

Leana is the founder of Miles For Family. She enjoys beach vacations and visiting her family in Europe. Originally from Belarus, Leana resides in central Florida with her husband and two children.

[…] Plus, there is something to be said on the beauty of keeping things simple. All you have to do is pick a sailing, call Citi Travel Center and apply points towards your cruise. Boom. If you don’t have enough points to cover the entire bill, you can simply co-pay with a credit card. Speaking of, Citi Thank You Premier would be a decent choice because it earns 3 points per dollar on travel. You can combine Thank You points with anyone for free. […]