One or more of these credit card offers may no longer be available. See our Hot Deals page for the latest offers.

Update: Walmart gift card redemption option is no longer offered.

Well, the title is self-explanatory, right? My fellow hobbyists, I have committed an unforgivable sin. If there was a Miles and Points inquisition, I would be burned on the proverbial stake right now.

Let’s have a moment of silence. Yes, instead of saving my points for travel redemption or miles transfer, I did the most unsexy thing possible, well, other than becoming a stay-at-home mom. But you know what? I redeemed my points for food, and I liked it! I’m getting something tangible for all the effort I’ve put into The Hobby over the last few years.

But what about “free” travel? Oh, we are still gonna do that! What convinced me to take this unpopular route was my interaction with Cheapblackdad in this post. Read the comments, he actually makes some good points.

I sat down and looked at the stash of miles and points I already have, and realized I have the next three years covered. That includes going to Europe, bringing my parents here etc. We are infrequent travelers and frankly, my husband is getting sick of all these trips. He is becoming such a homebody, and if he ever retires, he will sleep non-stop. It’s disgusting! Why would you want to live like that? I’m kidding , he is a good counterbalance to my madness.

But the truth is, we can use extra money right now and to me, Walmart gift cards are almost as good as cash. You can only save about 2-3% on them by going through Giftcardgranny, and many times, they send those printout certificates that confuse the heck out of cashiers. Frankly, I stopped getting them for that reason. Of course, you can buy Walmart gift cards with gift cards online, but honestly, it’s a lot of trouble to save just 2%.

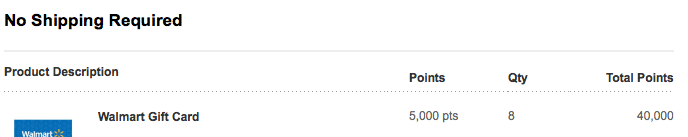

Actually, even after redeeming that amount, we still have 143K Thank You Points between our accounts. That should be enough for my upcoming plans. We have a huge bill for our cruise to Alaska coming up in a few months, and really need to save every penny we can. That $400 gift card will be enough for almost a month worth of groceries.

Also, I don’t plan to stop signing up for new cards unless the banks stop me. I think some of us hobbyists are like actors. You know what they say: Every actor thinks that their current job is their last one. Well, I feel that way about sign-up bonuses. On the other hand, I absolutely detest hoarding.

So, my focus is shifting to cash from now on as long as decent offer is available. And I started implementing my strategy right away. Few weeks ago, I wrote about increased offer on Amex Blue Cash and Amex Everyday. Unfortunately, both are down to their normal levels now.

I actually wasn’t planning to get either one because they didn’t meet my criteria of $350 value per sign-up. But I changed my mind and applied for Amex Blue Cash in both mine and my husband’s names. There are two reasons:

- Small Business Saturday is coming up. We don’t yet know all the details, but there will be some sort of incentive. So, the bonus is worth more by that logic. How much more? Only Amex knows.

- I should be able to convert this card to Amex Blue Cash Preferred if the whole churning gravy train comes to an end. The latter is my top long-term credit card pick for family.

So we applied, and both got the dreaded 7-10 day message. I’m still waiting to hear back and keep checking this link for an updated status. My policy with pending applications is to just wait it out. I’m extremely impatient, but logic dictates that it’s best not to draw attention to my multiple applications within the last two years. As far as my husband’s apps go, there is no possibility of reconsideration because he refuses to call, even when I offer to handle most of the conversation. You pick your battles, and I choose not to fight this one.

I also decided to shift my strategy to bonuses that can pay for food or other necessary items. Obviously, I prefer cash, but a decent gift card will do. That’s why I’m planning to apply for Capital One Venture Rewards as soon as I’m done with minimum spending for our current cards. Even though the bonus is marketed as credit for travel purchases, you can redeem points for gift cards, among them Amazon.

We don’t spend as much money on Amazon as we used to (so long, diapers!), but I still buy coffee, tea and some food through that website. Unless things have changed, 40K points should give me $400 in gift cards. Of course, this offer comes with three credit pulls (gasp), and my husband might not get approved. I’m not even going to try in my name. Capital One hates me (read this post).

If we get Capital One offer as planned, I’m going to try for Barclaycard Arrival Plus next in mine and my husband’s names. The reason? We can use sign-up bonus for tips on our cruise and taxes on award tickets to Europe. The goal will be to reduce our upcoming cash expenses and burn the miles and points in the process. Side note: You can read about both cards in my page “Best credit card deals for family”

I want to reduce my stash as much as possible before I start accumulating more. The other day, I was able to talk one of my readers out of buying Avianca miles. Turns out, that person has 1 million AAdvantage miles! Don’t buy if you are in the same spot.

Image courtesy of Ambro at FreeDigitalPhotos.net

Image courtesy of Ambro at FreeDigitalPhotos.net

The smile on the stock photo is meant to convey that I’m not being hostile or obnoxious with my advice. But please, pretty please, use the miles you already have. Also, I strongly advise you focus on cash back and hotel points’ bonuses for the time being.

Of course, I do want to have some “emergency” miles on hand at all times because my family lives in Europe and I would hate to have to buy a last-minute ticket. But realistically, I don’t need more than 100K miles for that. So, that’s the goal: Reduce my permanent mileage balance to 100K miles and keep it that way. Honestly, even that sounds too high. I do still plan to get mileage sign-up bonuses when it makes sense, but preference will be given to cash and gift cards, and I will settle for as little as $250.

Readers, what is your strategy? Why?

P.S. Tomorrow, the transfer ratio from Amex Membership Rewards to Avios (British Airways currency) will be cut by 20%. I wouldn’t make a speculative transfer, but if you’ve been thinking about it, now is the time.

Click here to view various credit cards and available sign-up bonuses

Author: Leana

Leana is the founder of Miles For Family. She enjoys beach vacations and visiting her family in Europe. Originally from Belarus, Leana resides in central Florida with her husband and two children.

Take a look at the Thank You rewards site now. Completely sucks! I was going to cash in my 50K points for a Walmart card and guess what? No longer offered! The representative said Walmart was removed as of March 2016. Now all they have left is complete crap. You can get gift cards for clothing stores or restaurants and not much more. I don’t want a $500 gift card to Red Robin. I don’t want or need a $500 gift card to American Eagle. Gone is Amazon, Walmart, even Cabelas. I’m glad I switched my card over to the double cash rewards as this “new and improved” Thank You rewards is complete garbage!

@Tony Yup, the post is a few years old at this point, I need to update it. I totally agree, Citi gift cards options right now are pathetic. I’m not sure if you can utilize Jet Blue points, but there is a 50% Citi/Jet Blue transfer bonus going on right now. Not a bad deal at all, as long as you can burn the points on flights. Might be worth it to transfer speculatively. Read my post here https://milesforfamily.com/2017/01/13/jet-blue-program-gem-many-middle-class-families/

The below gets deeper as the numbers go up. You are warned.

1. Pick your spots.

2.In the end, cash is king. Period.

3. The travel rewards sign up bonuses (SUBs, because I realized I say this a lot in this post) are so much bigger than the cash SUBs, which is why it typically makes sense to prioritize those. When you do start seeing cash SUBs around points SUBs (for me, around $400 in value), that means it may make sense to go the cash route. UNLESS the points have an incremental value equal to more than the cash, e.g. getting 40,000 more UR will allow you to redeem that $1,000 reward.

4. The idea of saving money with these sign up bonuses has been making me chuckle lately. I wonder what my bank account would look like if I had never started this hobby.

5. But the memories, you say? Those are priceless you say? Actually, I’d say I can put some sort of monetary value on those memories. Let’s keep it simple. Say I’ve spent $2,000 over the past two years on trips that I would not have taken if it were not for the fact that points subsidized some portion of it. Those memories are worth at least $2,000. Say it was 4 trips that I would not have taken without this hobby. That means each trip is, on average, worth $500 in memories. Now, would I rather have all or some of that money in a bank account in exchange for some or all of those memories? Am I willing to pay more, less, or the same for those memories going forward?

6. I think the value of these trips decreases going forward, too. After 2 years of 8+ points & miles subsidized trips, I think the value of trip memories are starting to come back down to the value of “At Home” memories like coaching the kids baseball teams or doing a puzzle, or swimming at the Y, or doing a bike ride. Vacation/trip memories have a higher value, but I think the gap is closing faster than the cost is.

7. I’d say that I’ve gotten around $750/trip in memories value from our trips, and only paid $500 on average. That’s a good deal. Next year, after the graduation/family back to living together trip, I think we’d value a single trip’s worth of memory at half that. But I think the cost is the same, if not more as the kids get older. The math no longer works. We’ll be staying put until we value those memories at least as much as or more than the cost of getting them.

@Cheapblackdad Good to have you, as always! Sometimes I think of you as my black twin of sorts. 🙂 Or black kindred spirit, you pick. Yeah, I pretty much agree. Although your analysis made my head spin, I won’t lie, your points are spot on.

The idea that this hobby saves money for most of us is pretty much ludicrous. Sure, there are few who probably get sign up bonuses and then sell the miles for cash etc. The scrooges of The Hobby. But for most of us, it’s an expensive pastime, especially for those of us on a budget. I have to really watch myself, those trips sure do add up. The gas, dining, activities, even if you don’t have to fly, it can be expensive if you do it on a regular basis.

That said, I don’t have any regrets. I’m glad we can travel with our kids on a scale that we do. Of course, my daughter is now addicted and expects a getaway every weekend. Umm, no. I think it’s important to find the right balance so it doesn’t take you away from other important things. I’m still working on that one.

First off, this post in particular really relates well to me. I love to travel but we don’t travel that frequently. We do however eat several times a day, drive our car daily and need things from stores regularly so sometimes I just like cash/gift cards for what I need! Like the time we needed a lawn mower and used my husbands am ex points for Home Depot gift cards. Not sexy, just practical! Secondly, I have the am ex blue cash card so I am curious about converting to the preferred. How and when do I go about it? Have you written about it in another post?

Thanks as always!

Julie, I’m very much the same way. I have redeemed points for gift cards quite a few times in the past. I was hesitant on this one because we do need a lot of miles for trips to Europe. But at certain point, I think it’s more important to take care of present needs. We are low on savings, and have a lot of bills coming up. And Walmart is where I shop anyway. So, this just seemed logical. Maybe I’ll regret this decision later, but I’m willing to take my chances.

As far as converting your Amex Blue Cash to Preferred, you may want to try a “chat” with Amex rep. This option should be in your profile under “Contact US” section. It really depends on what cards are eligible for conversions and what are not. I was told before that you need to have Amex card for at least 12 months in order to do it, but I was able to convert at 11 months’ mark. So, it just depends.

I don’t foresee you having an issue because you have the no-fee version of the same card. If they tell you “no” I would call them and try again over the phone. Be aware, Preferred version has $75 annual fee, but it’s worth it to get 6% cash back on groceries. Of course, it does depend on how much non-bonus spending you have. Please, let me know how it works out. Thanks for comment and for reading my blog!