The short version is: Everything went well… I think. Now, on to the long version. I’ve written about Wells Fargo Propel’s bonus a few times. The card does not pay me commission, in case you are wondering. On one hand, the bank is super quirky. My husband’s card was approved on its own after a few days. I had to fax 2-years worth of tax returns for my application… twice.

On the other hand, you can’t argue with the fact that the bonus is very attractive. Not only do you get $400 credit (on anything, not just travel), but there is a $100 airline allowance, which actually paid for taxes on my award tickets. So, in actuality, the bonus can be worth $500 under certain circumstances. That’s a huge incentive to me.

So, we finally met the minimum spend on my husband’s card and got our 40,000 points posted to the account. Yay! The total added up to 43,614 points. The website is very buggy. I had to log into my husband’s rewards program a few times before it finally registered. There are several options on how you can redeem the rewards.

You can get a statement credit (may take 6-8 weeks to post) or check. You can also redeem your points for gift cards. There is an option to redeem for travel, and I have seen reports that you can get 1.3 cents(or more) per point toward airfare through this method. However, it requires a banking relationship with Wells Fargo. Follow this thread for more details. Otherwise, you get 1 cent per point and can copay with cash, if you don’t have a sufficient rewards balance for your flight or hotel booking.

Aside from travel options, the redemption starts at 2,500 points and equals to $25 check/statement credit or $25 gift card for various retailers. Obviously, there isn’t any incentive to get a gift card, except some were offered for only 2,250 points (10% off) as part of a special promotion. Among the featured retailers was Staples. Hmm, I buy paper towels there as well as other stuff, and 10% is a decent discount. I checked Giftcardgranny, and Staples gift cards were selling at 5% off.

My goal was to zero out my rewards balance. I’ve decided to try to get $100 in Staples gift cards and redeem the rest of the points for a $350 check (I didn’t want to potentially wait 6-8 weeks for statement credit). The only problem was: I needed 44,000 points and I only had 43,614. Looking around the website, I saw that there was an option to gift points from another account. Apparently, it could be done at no cost.

I had about 1,600 points earned from my Propel card, so I tried to transfer 386 points to top off my husband’s account. No dice, once again Wells Fargo site was being buggy. I called, and the lady said it could be done at no charge, but my husband had to verify his identity. Alas, he was at work.

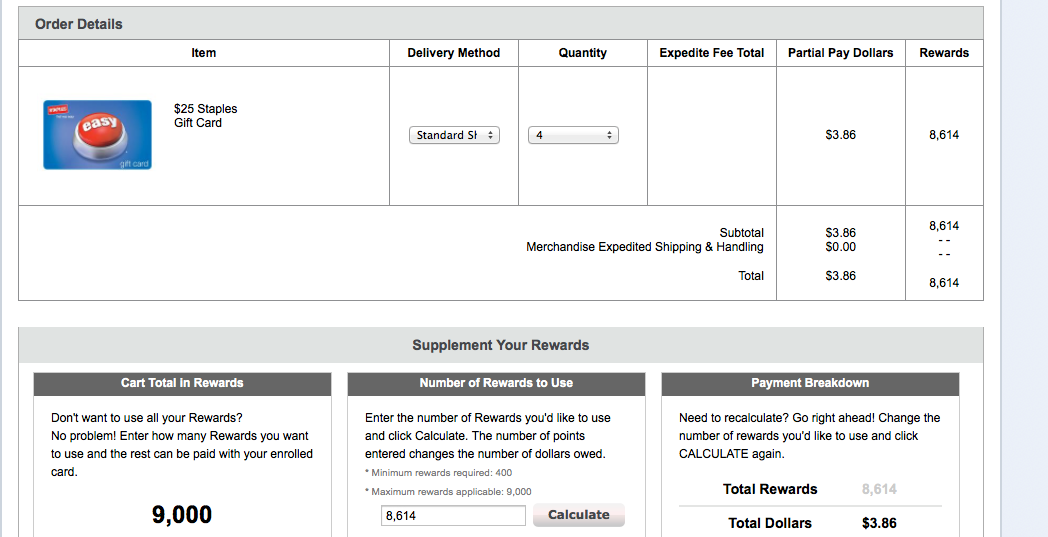

But then I discovered something interesting, while playing with various redemptions (it’s a bored housewife thing). You could co-pay with any credit card, if you didn’t have enough points for a gift card redemption. How cool is that? It allowed me to use 8,614 points and pay $3.86 to get $100 worth of Staples gift cards.

I did just that. I also went ahead and redeemed the remaining 35,000 points for a $250 and a $100 checks. Those were the levels offered, and you had to make each redemption separately. I have already received my gift cards and currently waiting for checks to arrive. I’ll update if there are any problems.

Bottom Line

If you are willing to jump through some hoops, Wells Fargo Propel offers a very lucrative bonus. Unlike miles or hotel points, you can get cash or discounted gift cards for places where you actually shop for your everyday items. Those are my favorite type of rewards!

P.S. There is a developing story on Avios program. The short version is: There may be a massive devaluation to short-haul redemptions coming very soon. Milenomics has written a good post on what steps you should take right now.

If you liked my post, please, subscribe to receive free blog updates through email and recommend me to your family and friends. You can also follow me on Twitter, like me on Facebook and download my e-book If you found my content helpful, consider doing your Amazon shopping through my affiliate link.

Author: Leana

Leana is the founder of Miles For Family. She enjoys beach vacations and visiting her family in Europe. Originally from Belarus, Leana resides in central Florida with her husband and two children.

Thanks for sharing your experience. Do you think this is a better card to get than the Capitol One because of the $100 airline allowance?

Nancy, for me personally, yes. Keep in mind, the $100 credit may or may not trigger, depending on the charge. It has to be coded properly. I recommend, you follow the referenced thread for more info and data points. My charge was for BA award taxes.

Also, be prepared to fax your tax returns. You may not have to, since my husband’s app was approved on its own, but chances are pretty good that they will require it. Still, if given a choice between Capital One and Propel, I would get Propel. That said, I probably would try to get Capital One Venture later on as well.

Congrats on getting your bonus! It sounds like they really did make you jump through a bunch of hoops. Two years of tax returns? That’s insane!

Holly, I’m glad it went OK. I was a bit worried about more potential quirks. Of course, now I have to worry about WF employee stealing my identity at some point!