I recently got a request to outline a strategy on how a family of five can fly to Europe close to free. I’ve had some interaction with this particular reader, so I know some specific information that pertains to her situation.

For example, I know that her preferred airport is Dallas and that her children are all school age. She wants to go 2 years from now, presumably in the summer, since that’s when the kids have the time off. I have already outlined a strategy on how a family can fly from Boston to Dublin for only 25,000 Avios miles roundtrip per person.

However, let’s assume that you have no interest in going to Ireland and don’t really want to connect through Boston. Are there any other alternatives? I’ve only chosen non-targeted offers with the minimum spending requirements that would be manageable for a regular middle-class family.

The credit cards and schedule of applications

1. First round of applications.

The US Airways® Premier World MasterCard®

It comes with 40,000 miles after the first purchase and $89 annual fee, not waived. It pays me commission. Both spouses get one in each name. I recommend you apply for these cards first because Barclay’s doesn’t like to see many recent credit pulls.

Chase Sapphire Preferred

It comes with a sign-up bonus of 40,000 Ultimate Rewards points plus 5,000 points for adding an authorized user. The minimum spending to get the bonus is $3,000 in 3 months. Annual fee is waived. The card pays me commission. Both spouses get one in each name.

2. Second round of applications.

CITI AAdvantage Mastercard

It comes with 50,000 miles after spending $3,000 in 3 months. Annual fee is waived. Both spouses get one in each name. The offer does not pay me commission and you can find the link in my Bonuses page.

Even if you got in on a 100,000 mile offer, you should be able to get approved for this card, since it’s a different version. However, it’s prudent to space your Citi applications a few months apart.

3. Third round of applications.

Chase British Airways Visa

It comes with 50,000 Avios (BA miles) after spending $2,000 in 3 months. Annual fee is $95, not waived. It pays me commission. Both spouses get one in his and her name.

The reasoning

Why start out with the US Airways card and Chase Sapphire Preferred? Why, they both pay me commission, of course! Actually, that’s not the reason. The first one will be gone in the next few months, and I have promoted it for a long time before it started paying me a dime.

As far as CSP card, there is a method to the madness. Since I want you to apply for Chase British Airways later on, I would like to have a space of 6 months between Chase Sapphire Preferred and Chase BA Visa. I personally like to do my Chase apps in this manner. Additionally, now you can get a bonus on CSP card after 24 months. So, my reasoning is: The sooner you get it, the sooner you’ll be eligible for it again.

You can swap CSP cards for AAdvantage cards if you wish, though the CITI 50,000 miles offer doesn’t seem to be going anywhere at the moment. However, I can’t predict the future, so make your own call on that one. I’ve previously put a list of some ideas on meeting minimum spending requirements, in case you decide to sign up for AAdvantage cards at the same time.

Dallas is an American Airlines hub, so that’s why my focus is on cards that earn miles redeemable on Oneword alliance.

The totals

I am making an assumption that Dividend miles and AAdvantage will merge by next summer. If you get all the cards I mentioned, here is what you’ll end up with after 9 or 10 months, taking into account the points earned from the minimum spend:

Him:

40,001 Dividend miles (US Airways) +

53,000 AAdvantage miles (American Airlines) = 93,001 AAdvantage miles

52,500 Avios (British Airways miles)

48,000 Ultimate Rewards points from Chase

Her:

40,001 Dividend miles (US Airways) +

53,000 AAdvantage miles (American Airlines) = 93,001 AAdvantage miles.

52,500 Avios (British Airways miles)

48,000 Ultimate Rewards points from Chase

The strategy

One way flight to Europe:

We will start out by transferring Ultimate Rewards to British Airways Avios. Wait and check availability first because the transfer is instant. I would cancel Chase Sapphire Preferred once the transfer is complete to avoid paying the annual fee.

After the transfer, a wife and a husband each will have 100,500 Avios in their account. Remember, British Airways Avios program lets you pull your miles for those living in the same house. So, the total will be 201,000 Avios.

We’ll be looking for flights from Dallas to Dusseldorf via New York (American hub). Since all flights are priced per segment, it will cost 10,000 Avios from Dallas to New York on American and another 20,000 Avios from New York to Dusseldorf on Air Berlin: 30,000 Avios total per person.

At this time, Air Berlin only releases 4 seats in economy and 2 seats in business (on some flights). Assuming you can find a business class seat, it will cost you 60,000 Avios for a one-way flight from Dallas to Dusseldorf via New York (double the cost of economy).

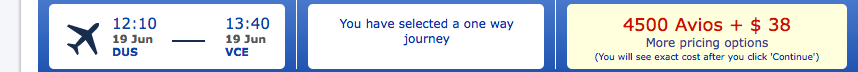

So, the total will be 180,000 Avios for 5 people. You’ll have 21,000 Avios left. You can use those to add a flight to Venice (or other city) for 4 people at the cost of 4,500 Avios per ticket. You can always buy the 5th seat or put an extra $1,200 on the Chase BA Visa, so you’ll have 22,500 Avios needed for 5 one-way flights. Check out my first ever screenshot. Baby steps…

You get 2 points per dollar (3 on the first Friday of the month!) on dining with your Chase Sapphire Preferred (from which we transferred to Avios program), so your total might add up to the amount needed for 5 tickets after all.

You’ll have to call and book these flights over the phone because BA search engine isn’t sophisticated enough to put all these flights together via online search. If a non-stop flight from Dallas to New York isn’t available, you’ll have to connect and both legs will be priced separately. Fortunately, BA program lets you copay with cash on international flights, so you can make adjustments if needed.

One way flight from Europe back to US:

Assuming you’ll be flying in the summer, it will cost you 30,000 AAdvantage miles for a one-way economy flight from Europe to the US. The pricing is flat (not per segment), so the flight can start anywhere in Europe. You’ll want to avoid British Airways and Iberia, since those have fuel surcharges added on. Ideally, you’ll be able to find something on American metal, so you only will have 1 connection in New York.

Once again, we assume that there are 4 tickets in economy and 1 in business. So, you can book 3 economy seats from one account and 1 economy + 1 business seat (50,000 miles) from the other. Remember, we have 93,000 miles in each account.

If you follow all the outlined steps, you should have the needed miles in 10 months. You can only book 331 days ahead through AAdvantage and 355 days ahead through BA Avios program on Air Berlin. So, if you are looking to visit Europe in June of 2016, you’ll be able to get everything ticketed sometime in July of 2015.

The caveats

You knew this was coming! First, 1 year in this hobby is like 5 human and 10 cat years. A lot can change in this space of time. We don’t know for sure if AAdvantage and Dividend miles program will merge by then, though they should.

We don’t know what the new American award chart will look like, but my guess is they will keep the US-Europe summer pricing of 30,000 miles in economy one-way. The most vulnerable spot is the off-peak award that costs only 20,000 miles between October 15-May 15.

That’s because United and Delta price US-Europe award rate at 60,000 miles roundtrip, and airlines are copycats. This is just a guess on my part. Another dark horse is the BA Avios program. My guess is it should stay the same for the next year or so, but it’s just a guess. Will they keep Air Berlin redemptions fuel surcharge free? I hope so.

Also, the biggest challenge is accommodating 5 people. Flexibility is crucial, and you may need to pay for 1 or 2 flights out-of-pocket. My advice is to have a Plan B for these miles, so you won’t be severely disappointed if things don’t work out.

Always have a Plan B for your miles when planning to redeem for a large family.

Click here to view various credit cards and available sign-up bonuses

Author: Leana

Leana is the founder of Miles For Family. She enjoys beach vacations and visiting her family in Europe. Originally from Belarus, Leana resides in central Florida with her husband and two children.

Thanks for writing this! I’m going to need to study this in detail! We already have the Citi AA cards that we used for Hawaii, so I might need to switch that up a bit. We’ve also thought about going over Spring Break of Thanksgiving to possibly save on points on American. Thanks again!

Shoesinks, you are welcome! I highly recommend you at least consider the 100K offer for CITI Executive card. Look under “most current links” http://www.flyertalk.com/forum/credit-card-programs/1511082-active-again-100k-miles-citi-executive-aadvantage-offers-read-wiki-before-posting-484.html

It’s a different product, so you should get the bonus. It disappeared for awhile, but seems to be working for now. It does have $10,000 minimum spend in 3 months, so think and decide if you can possibly pull it off. The annual fee is $450, but it also comes with $200 credit. It doesn’t pay me anything. See this post for some MS ideas that don’t require too much effort. http://romsdeals.com/2014/06/26/my-top-3-lazy-ways-to-manufacture-spend-and-earn-free-points/

If you can possibly do it, I recommend you get this card while you still can. It would take care of 5 one-way tickets to Europe in the off-season, if they still offer 20K redemption at that time. Spring break should be nice in Italy and France, just don’t go further north! 🙂

@Shoesinks Another option I wanted to mention is to check your local Chase branch and see if they offer Chase United Mileage Plus card with 50,000 miles bonus after spending $1,000 in 3 months. You could always transfer Chase Sapphire Preferred points to United to get what you need for 5 seats.

For the flight back, you could use BA Avios and just copay with cash for the missing miles. That way you wouldn’t have to come up with 10K spend in 3 months. I still recommend you at least consider the CITI card I mentioned, as it is a very good deal.

Hope, it makes sense, and email me or comment with any further questions.

“First, 1 year in this hobby is like 5 human and 10 cat years. A lot can change in this space of time.”

That is hilarious and so true! Read any point/mile blog from a year ago and it practically makes no sense now =/

Holly, to me this is the biggest challenge in miles and points blogging. I write a post and pray that the card offers will still be there tomorrow morning and airlines don’t pull some sort of a stunt. Things change so fast. Your info can become irrelevant overnight.

But I don’t have to tell you that ! I’m sure you deal with similar issues writing for FTG blog.