I have a hard time passing up a 0% interest offer on credit cards, especially with the way interest rates are these days. I just took advantage of a 0% offer to spread out payments on a larger purchase.

Chase Pay Over Time Offer

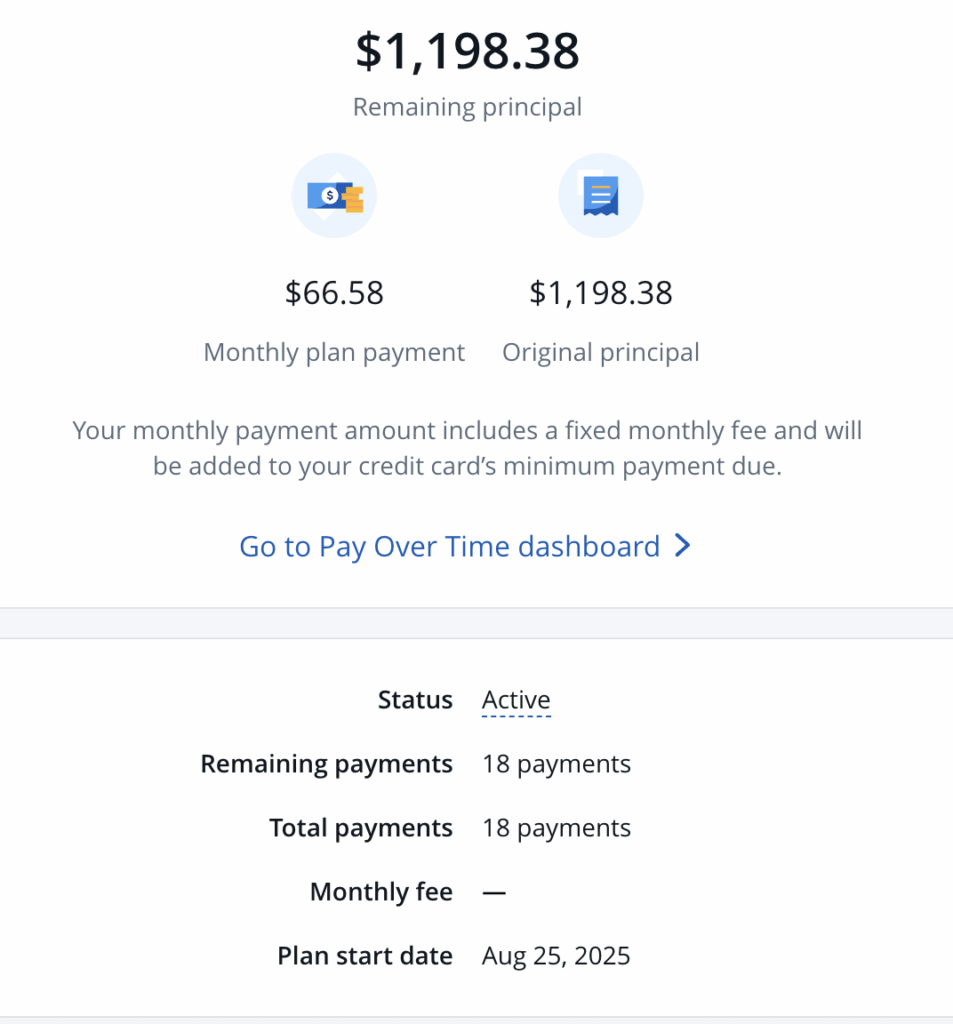

Chase bank has a Pay Over Time feature that allows credit card customers to break up purchases over $100 into smaller monthly payments. The feature tacks on a fixed monthly fee instead of an interest charge.

From time to time, Chase offers Pay Over Time with waived monthly fees, which means you can spread out payments with no interest or extra fees. Leana took advantage of such an offer last year when she had some unexpected house repair bills (see this post).

I’ve received texts and emails from Chase a few times offering a zero monthly fees on my first plan, but until now, I’ve always just paid the entire bill in full. But, last week I received another notice from Chase inviting me to break up my Hershey Lodge charge on my Chase Sapphire Preferred card into smaller payments with no fees. Since we recently added another driver to our car insurance and insuring teenage boys costs a fortune, I decided now was a good time to take Chase up on this offer.

The longest time period offered was 18 months. My almost $1200 charge would now be $66.58 per month, no interest, no extra fees:

My son is currently working on the minimum spend for the welcome bonus on the Chase Sapphire Preferred card, and we charged a big car insurance bill on that card. I’ll be working with my son to see if the same no-fee offer pops up for him.

Have you taken advantage of a no-fee offer for Chase Pay Over Time?

Leave a Reply