When it comes to using miles and points for free travel, there is no definitive “right” and “wrong” way. It all comes down to your risk tolerance and travel preferences. That said, there are definitely some actions that prevent families from maximizing rewards. Here are some common mistakes.

Using the Same One Travel Credit Card Forever

Families with a lot of monthly spend can rack up a decent amount of miles/points using the same travel credit card that they’ve been using for years. However, the best way to acquire a large influx of miles and points is by signing up for a new credit card when it has a large welcome bonus. Many new credit cards require $5k or less spending in 3 months to get anywhere from 50,00-100,000 bonus miles. Ca-ching! See here for some of the best credit card offers out there right now.

Owning Only Airline Credit Cards

Airline miles are great, unless there is no award availability for when you want to fly or the price of award flights is sky high. Then, your miles are useless. Rather than owning only airline credit cards, expert travelers also own credit cards with flexible points that can be transferred to multiple airlines (and hotels). Cards I recommend include Chase Sapphire Preferred, Capital One Venture Rewards, Capital One Venture X, American Express Gold card.

Adding Authorized User Instead of Player 2

When you open a new credit card, you can always add your partner/spouse as an authorized user. However, when you do this, you still only get one welcome bonus. But, if your spouse or partner signs up for the same credit card under their name, you can get two welcome bonuses, which is double the amount of points. We call this the two-player strategy. And remember, you can use your combined income on each application.

Not Applying for Small Business Credit Cards

Many people actually have a small business without realizing it! And if you do, you can apply for a different set of small business credit cards that will help you add to your miles and points stash. For example, do you pet sit or babysit? Sell stuff on Facebook Marketplace? Those can qualify as a small business. See this article for more information. My top small business card recommendation is Chase Ink Business Preferred.

Forgetting to Meet Minimum Spending Requirement for the Welcome Bonus

When you sign up for a new credit card, the welcome bonus doesn’t come automatically. You must spend a certain dollar amount within a certain time period in order to get that bonus. Pay attention to amounts and dates, and put reminders on your calendar.

Using Points in Travel Portal/Statement Eraser Instead of Transferring to Travel Partners

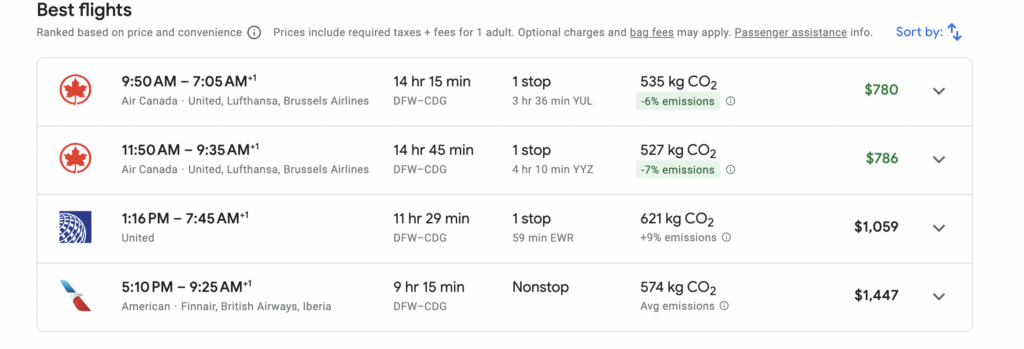

When you have flexible points, it’s so easy to use them to book travel in the bank’s travel portal or use them to erase travel costs from your statements. But often, you get more bang for your buck if you transfer those points to an airline instead. For example, with Capital One, I can book a one-way ticket from Dallas to Paris in July for as low as $780 cash and then use 78,000 Capital One miles to erase that purchase.

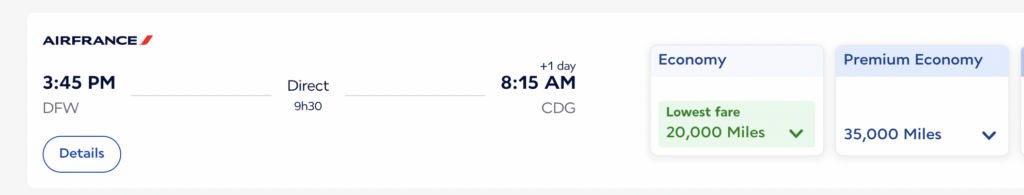

OR, a much better deal is transferring my Capital One miles to Air France Flying Blue program at a 1:1 ratio. I see that I can book a nonstop flight for just 20,000 miles in Economy or 35,000 miles in Premium Economy: (I always recommend looking at award availability before transferring)

Not Planning Far Enough Ahead

It takes time to earn miles and points from credit cards, and the points from a new card’s bonus don’t hit your account until 3-4 months after your application. Plus, often the best award availability is is ~11 months out. So, don’t wait until the last minute. It pays to plan ahead.

Final Thoughts

Traveling with miles and points is an amazing way to travel the world for less money. Avoid these mistakes to maximize your travel benefits.

Readers, do you have anything to add? Sound off in the comments.

Author: Nancy

Nancy lives near Dallas, Texas, with her husband and three kids. Her favorite vacations include the beach, cruising and everything Disney.

I’m in a similar boat with airline miles. I love using those because if you need to make a change, or cancel, the flexibility is so far beyond using cash or flexible currencies.

@projectx Yes, I love having that cancellation flexibility with miles!

I would say your tip about transferring via buying outright very often works in reverse, ie that it can be fewer points to buy outright vs using miles+ fees. And of course, you can earn a few miles as well.

One reason I like miles though is that besides Delta afaik most awards are economy vs basic economy. It’s important to compare apples to apples when doing the math. Also, cancellation options are often superior.

Great point, Audrey! It’s bests to look at both options to see which one makes more sense. It is hard to beat the cancellation options on miles, true.