Recently, a reader asked me to help lay out a credit card strategy for booking a family of 4 from Austin, TX to Switzerland using miles and points in 2025.

First of all, I’m a huge fan of Switzerland! In case you missed my trip report from 2022, you can read it here.

Secondly, I’m so happy that this reader is asking this question NOW as opposed to asking it a few months before they want to travel! This strategy takes time to plan and implement.

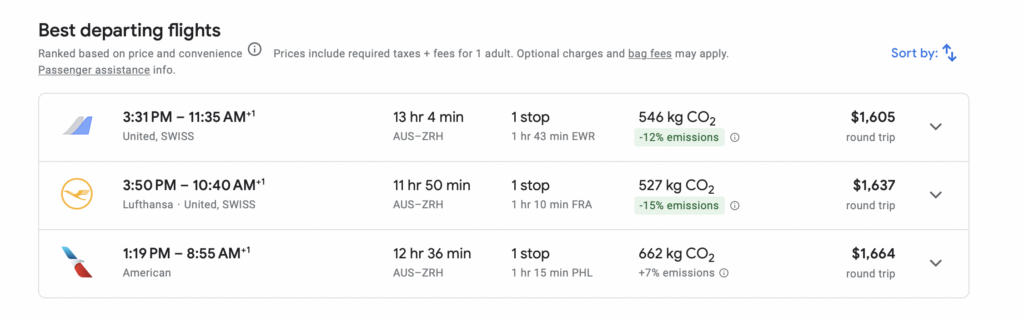

I looked on Google Flights to get a general idea of the price of flights from Austin to Zurich in June. They are running about $1600 round-trip in Economy per person. That’s $6400 for a family of 4, and that’s a big chunk of cash.

Traveling with miles and points from credit card bonuses can cut that cost down to a more reasonable level (not free, but definitely much cheaper).

General Advice

Leana and I love helping readers come up with a strategy to earn miles and points from credit cards to travel. In general, our advice to each reader is very similar:

- Start applying for credit cards well in advance. Plan on booking your trip 11-12 months in advance of your travel dates, and back up your credit card application timing in advance of that.

- Prioritize Chase cards due to its 5/24 rule (see this post)

- Prioritize cards with flexible miles/points instead of a single airline or hotel

- Don’t forget about small business cards and 2-player strategy (both spouses sign up for credit cards to each get the bonus)

- Pay off your credit card balances every month, and don’t go into debt!

- Explore routes to Europe from your city. Focus on getting across the pond on miles/points, and then hopping on a cheap cash flight to your final destination in Europe.

- Or, be open to positioning yourself to a key US city for a nonstop fight to your final destination in Europe.

Specific Advice for this Reader

This reader and her husband do not have anything that could count as a small business. If they did, I would tell them to first get the Chase Ink Business Cash card or the Chase Ink Business Unlimited card. These cards both have 90k bonuses and $0 annual fees. (Note: Offers have changed).

However, for consumer cards, the two cards I recommend for beginners are the Chase Sapphire Preferred (CSP) card and the Capital One Venture Rewards card. Both have relatively low annual fees and have flexible points that can be transferred to numerous airlines/hotels.

Since the CSP bonus is currently 60k and the Capital One Venture Rewards card bonus is currently 75k, I recommended to this reader that she and her husband apply for the Capital One Venture Rewards card first. They should each apply separately and space out their applications so that they can easily meet the minimum spending required ($4000) to get the bonus on each card. This card earns 2X miles on all purchases. After opening 2 cards and meeting the minimum spending on both cards, they should have a combined 166,000 Capital One miles.

Then, sometime in early 2024, they should circle back and each apply for the Chase Sapphire Preferred card. It would be nice if they could time this when the card has an elevated bonus of 80k like it did in the past. But, even if the bonus is 60k, it’s still a great card to have. If they each got this card, they would have at least 128,000 Chase Ultimate Rewards combined.

Recap: They should open 4 total new credit cards (2 for each spouse). Ideally, they should accumulate all miles/points by June 2024. Total miles/points accumulation is 294,000. Total annual fees= $380.

Possible award flights by transferring flexible credit card points to airlines

Capital One miles can be transferred 1:1 to:

- Aeromexico Club Premier

- Air Canada – Aeroplan®

- Cathay Pacific – Asia Miles

- Avianca LifeMiles

- British Airways Executive Club

- Choice Privileges®2

- Emirates Skywards

- Etihad Guest

- Finnair Plus

- Flying Blue (Air France/KLM)

- Qantas Frequent Flyer

- Singapore Airlines KrisFlyer

- TAP Miles&Go

- Turkish Airlines Miles&Smiles

- Virgin Red

- Wyndham Rewards

Chase Ultimate Rewards can be transferred 1:1 to:

- Aer Lingus AerClub

- Air Canada Aeroplan

- Air France-KLM Flying Blue

- British Airways Executive Club

- Emirates Skywards

- Iberia Plus

- JetBlue TrueBlue

- Singapore Airlines KrisFlyer

- Southwest Airlines Rapid Rewards

- United MileagePlus

- Virgin Atlantic Flying Club

- IHG Rewards Club

- Marriott Bonvoy

- World of Hyatt

Plus, airline programs have partner airlines and alliances. So, there are a lot of possibilities for booking flights! Here are a few options:

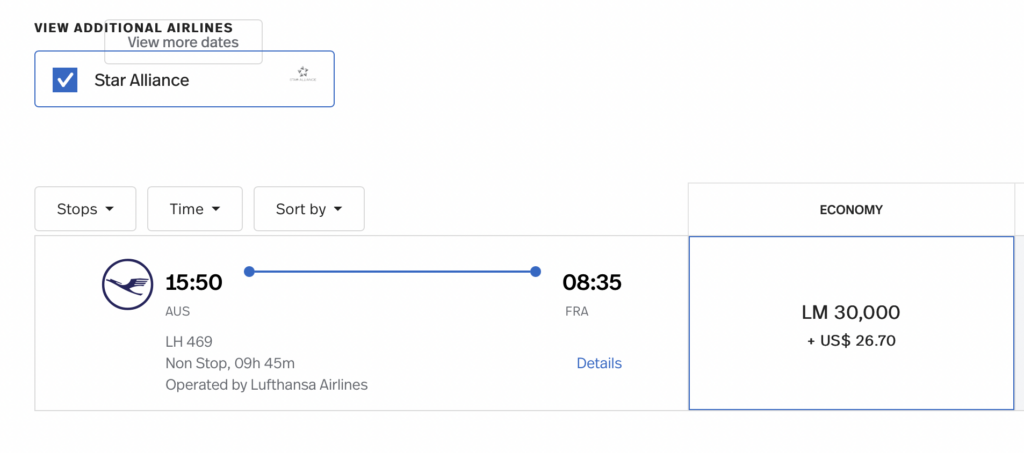

Nonstop Austin to Frankfurt on Lufthansa (using United miles, Aeroplan miles or Avianca LifeMiles): This nonstop flight is a great option because they could then take a 4-5 hour train trip from Frankfurt to Zurich, Switzerland.

One-way cost using Avianca LifeMiles: 30k points per person

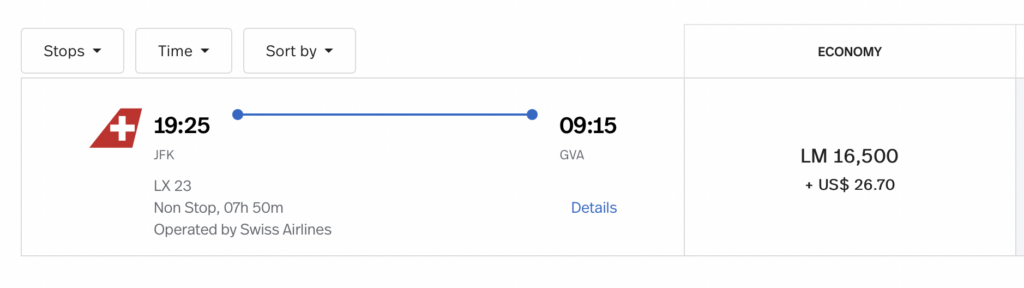

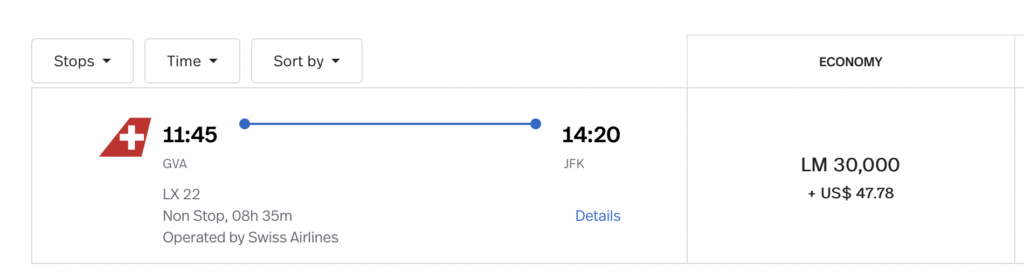

Another great option is to fly to New York first (using JetBlue points transferred from Chase) and then fly nonstop to Geneva. NYC to Geneva on Swiss Air: 16,500 Avianca LifeMiles:

Nonstop Austin to Amsterdam on KLM (Flying Blue): I’ve seen rates as low as 20k miles each way, but prices are highly variable.

Note that even with miles, you still have to pay some taxes on each flight leg. Some airlines pass on higher taxes/fuel surcharges than others. I typically avoid British Airways due to their high award flight taxes. Still, even with some credit card annual fees and taxes, the cost for 4 people from Austin to Switzerland on miles is still a lot less than retail price.

Bottom Line

There are many ways to use miles and points to fly across the pond and save money on a big family trip to Europe. Start early to allow yourself enough time to accumulate your miles stash, and look for award flights as soon as they are released.

Author: Nancy

Nancy lives near Dallas, Texas, with her husband and three kids. Her favorite vacations include the beach, cruising and everything Disney.

hi Nancy, i’ve been reading your very helpful posts to readers giving them advice, using points and miles. I wanted to see if you might be able to help me. I know it feels like it is last minute, but my family and myself are planning on flying to Switzerland in April using points and miles. We currently live in California. Do you have any tips or advice? There will be three of us

Hi Michelle! My biggest tip is to find award flights to anywhere in Europe, and then use cash to fly to Switzerland. Flights within Europe are usually pretty cheap. You will love Switzerland! Keep in mind that in April, not all hiking trails will be open. Let me know if you have any more questions!

Great post

Thanks!