See our Advertiser Disclosure and Editorial Note here.

I’m in the market for a new credit card. My husband and I currently have no minimum spending that we’re working on for a new card’s bonus, so why not earn more miles and points with another new card? (See my recent post about why now is a good time to apply for a new credit card).

Leana’s post yesterday about the Amex Marriott Bonvoy Brilliant card got me thinking about trying American Express again. It’s been 3 1/2 years since I was last approved for an American Express card. And, it’s been over 2 years since I first got the dreaded Amex pop-up box when applying for a new Amex card.

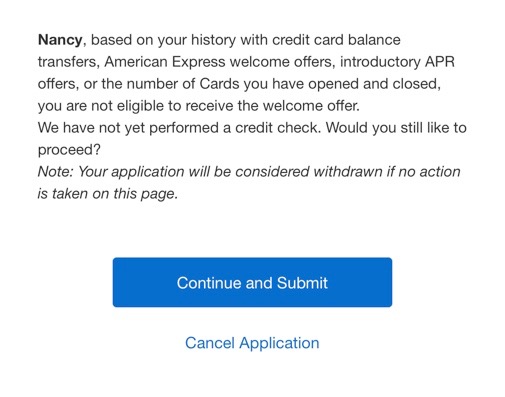

Yesterday, my husband and I each applied for a new Amex card. Unfortunately, we both got the pop-up box again. It looks a little different than it did before, but it’s still the same result:

How Did I Get Here?

Back when my husband and I both started this miles and points hobby 8-10 years ago, the environment was very different. Banks were approving people right and left for new cards. The popular blogs at the time all recommended application sprees every three months. The general advice was to apply for a card, meet the minimum spend for the bonus, and then move on to the next card. If the card isn’t a “keeper”, cancel it before the next annual fee hits.

That strategy worked well for several years. But as more people joined the miles and points hobby, banks realized they were not making money from our savvy group. Banks count on people to keep a credit card for years and carry a balance. We don’t do that. So, banks added restrictions and rules to make it harder for people like us to work the system in our favor.

In 2017, American Express started using analytics to weed out us point-chasers. They flagged people who signed up for a lot of cards in a short amount of time and didn’t put a lot of spend on them. Thankfully, Amex gives applicants a pop-up warning that we won’t be approved for the welcome offer before we hit the final submit button and get a hard inquiry on our credit report.

How My Behavior Has Changed

Now, I’m not opening and closing credit cards as aggressively as I used to. I make sure to put more than just the minimum spending on each new card.

I have one Amex card still open. It has no annual fee. Over the past year, I’ve been putting some spending on it off and on. For others in my situation, this has worked to get them off of Amex’s naughty list. I’m not sure what the magic number is, but apparently I haven’t hit it yet.

In the meantime, I pursue other lucrative credit card bonuses as they come up. I hope to get back in Amex’s good graces someday. But even if I don’t, I’m still doing ok.

Are you getting the dreaded Amex pop-up message?

CLICK HERE TO VIEW VARIOUS CREDIT CARDS AND AVAILABLE SIGN-UP BONUSES

Author: Nancy

Nancy lives near Dallas, Texas, with her husband and three kids. Her favorite vacations include the beach, cruising and everything Disney.

Wife and I have also been on the naughty list for the last couple of years however a few months ago I got a mailer for the Hilton card that had a personal offer code which seemed to bypass their list. Not sure I will keep trying AMEX unless I get another mailer.

@Erik Interesting that you got a mailer. I will be on the lookout in my snail mail. I will likely wait another year to try Amex again.

Yeah, that’s been my experience as well. I got a personalized code via mail to apply for Delta Gold card, and it was approved. Aside from that, I’ve taken advantage of Amex upgrade offers, but normal credit card applications get the pop up.