See our Advertiser Disclosure here.

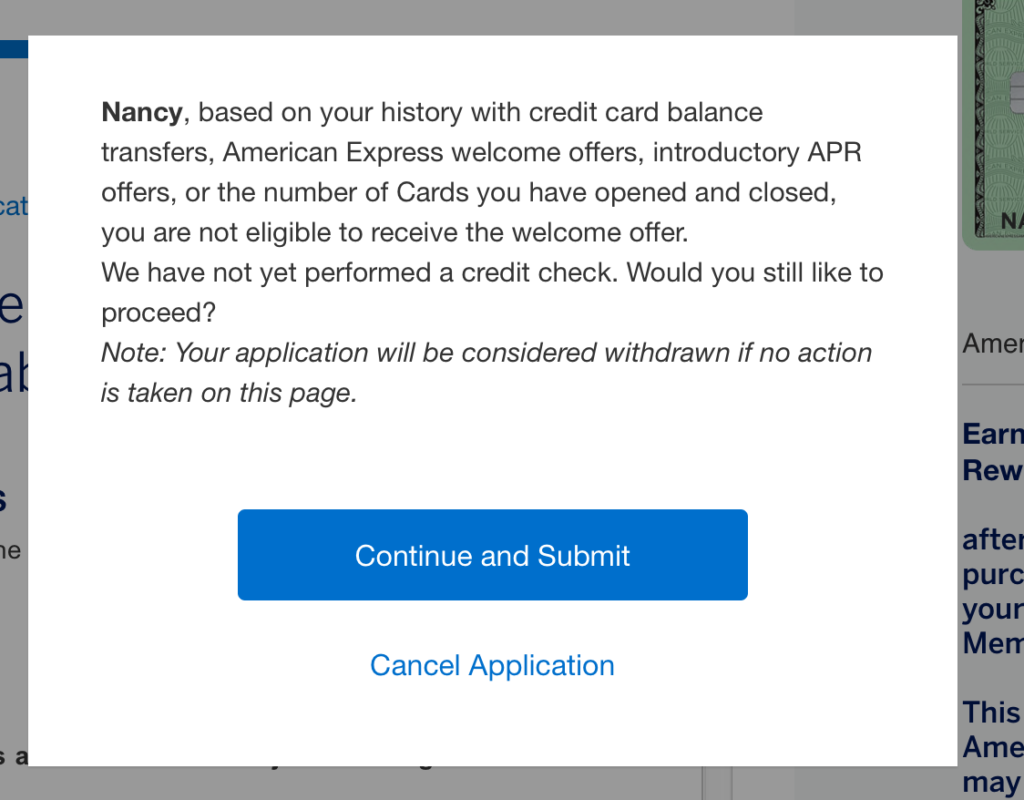

Back in April 2019, I applied for an Amex business card. I got the dreaded Amex pop-up box that alerted me I was not eligible for the card’s bonus due to my history with Amex.

Since that time, I put some spending on my existing Amex card. I also slowed down on new credit card applications, partly to position myself to be out from under Chase’s 5/24 rule.

And when I say I slowed down, I mean I slowed WAY down. In 2018, I was approved for 9 new credit cards. But in 2019, I applied for just two cards. My last card approval was in November 2019. This is the longest stretch I’ve had without a new credit card since I’ve been in this miles and points hobby.

Time for a New Card

This past weekend, I started thinking more about a trip to Europe with my family of five in 2022. My strategy will be to use miles and points for flights and pay cash for apartment rentals. I can start booking flights next summer, so it’s time to increase my miles and points balances to make sure we have enough. It takes a lot of miles and points for five round-trip tickets to Europe.

So, yesterday I made my move. I decided to apply for the Amex Green card via referral. The bonus from referrals is currently 50k points after spending $2000 in the first three months. The card has a $150 annual fee, not waived. Amex has a once-per-lifetime bonus for each card, but my husband and I have never owned the Amex Green card.

After I filled out the online application, I was shocked to get the Amex pop-up message. Again!

I figured that since I didn’t look like a churner for the past year, I would look more attractive to Amex. Nope! Amex still remembers how I opened and closed several Amex cards for the bonus.

My husband tried as well, and he got the same pop-up message. Dang it!

Plan B

I haven’t decided exactly which card, but I will be applying for another credit card soon. Now is a great time to plug away at minimum spending on a card to reach a bonus. We have upcoming holiday expenses plus our property taxes coming due soon.

Since I don’t need these miles immediately, I have some time to mull over current and future offers before making a decision. I hope that we see more good offers come out in the next few weeks.

How is your credit card strategy going this year?

CLICK HERE TO VIEW VARIOUS CREDIT CARDS AND AVAILABLE SIGN-UP BONUSES

Opinions expressed here are author’s alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.

Author: Nancy

Nancy lives near Dallas, Texas, with her husband and three kids. Her favorite vacations include the beach, cruising and everything Disney.

I have both Marriott amex cards and a delta biz, no personal card with amex ever, and still got a pop up. Currently under 5/24 as well. I keep trying for amex green every couple of months. Good luck to us all.

@Agnes Interesting that you’re getting the pop-up without any personal cards ever! I wish we knew what Amex’s criteria is for approval.

I had the received the pop-up in 2018, and then put approximately $6.5k in spending on the Gold card from Jan 2019-August 2019, when I applied and was approved for a Delta Platinum card. YMMV, but it does appear that Amex wants to see substantial spend on their cards. Hope this helps.

@Ben Thanks for sharing your data point. I haven’t put nearly that much spending on my existing card, so that is most likely my problem.

I get the pop up and hubby doesn’t. I even paid the $450 fee twice for the Aspire card. I don’t put too much spend on other cards though. Hoping that upgrades with hilton cards will work in future. I also just should have downgraded my Delta card instead of cancelling, hoping for another upgrade offer.

@Lynn Sorry you’re still getting the pop-up. I’m going to focus on other banks for now. I wish I could have gotten than 50k on the green card though.

Amex and other banks should ban you for life. Glad more banks are enforcing those rules now a day.

@Aaron Do you travel on miles and points? Or do you work for Amex?

I am with Aaron on this. And before you give me a snarky response – yes I travel on points/miles and no I don’t work for Amex, or any bank.

You have to look at it from the banks side. They grant cards because they want you to build a relationship with them. I remember growing up you would have just a couple of credit cards – a Visa, MasterCard and maybe an Amex. That was it – why would you need more then that? Now you got people churning cards just for the SUBs with no interest in building a relationship with a bank/credit union. When someone has over 10 credit cards and has opened more then 10 in a year, it’s very obvious to everyone, including a bank, you don’t care about them, you only care about you in that you are only using that bank for the SUB. So why should a bank do business with you then? If you honestly take the emotion out and look at it that way then you will see it from the banks side and understand why they do what they do.

So yes I agree with what the banks are doing and honestly wish they would do a once a lifetime restriction where once you get the SUB from them then you are done. It would cut down on the churning out there and it would make claiming award tickets easier as you wouldn’t have all these false miles/points out there being used on the limited number of award seats as a result of all the points out there from the churners. FQTV programs are meant to reward people for using that supplier and being loyal to that supplier. Of all the miles you have in a certain program, how many are actually from using that supplier and not from the SUBs?

@Richard and TheBrain Thanks for sharing your thoughts! I totally get how I’m not an attractive customer to some banks. However, Aaron’s response that I should be banned from all banks for life is harsh. I don’t feel that applying for new cards is gaming the system. Just because I’m not a great Amex customer doesn’t mean I haven’t developed long-term relationships with other banks. This miles and points hobby is not open to only those who can put $200k on credit cards or to those who have gobs and gobs of business travel. In the past, the formula was to apply for new card bonuses and move onto the next card. Now, that formula isn’t realistic based on bank restrictions. But for many of us, new card bonuses are still a big way to earn miles and points for free travel.

Sounds like you got banned, Aaron, or why are you really here posting?!

Lynn – he is probably trying to add a voice of reason that is sadly lacking on these blogs. I agree w him as well. There are those of us who have miles/points/status from many years of heavy travel (around 8 million frequent flyer miles for me since mid 80s) and others think they found a great way to game the system and use points:miles beyond what is anticipated by the banks and travel companies.

I have no problem with sign up bonuses and try to maximize my cards (3 Chase, including CSR and 3 Amex, including Platinum) to get value. I run almost all my annual spend (around $175,000-$200,000) through my cards. However I won’t game the system w gift cards, “create” a business or falsify info to get business cards, cycle credit limits or churn cards just for a bonus.

Right now I don’t see any cards I want since have Marriott, Hilton and IHG covered plus DL Platinum Amex (still have over a million AA miles and, while have had Barclays and Citi AA cards I just don’t see the value. I use CSR for no bonused categories and Amex Plat for flights (plus Amex promotions).

I have more than enough miles/points to do what I want and am lucky enough to be financially set for life so can afford anything I really want.

It is greedy people that try to Max the promotions or otherwise game the system that annoy me. Maybe they should be blacklisted for life.

“I didn’t look like a churner for the past year,” lol…that’s not long enough.

When will you and others be free of the dreaded pop-up box? Probably 7 years from now is my guess. The data points I have imply that AMEX keeps negative records for about 7-8 years before clearing their system.

@Jacob You may be right. Dang it!

Hi Nancy, my wife and I are in pretty much the same position as you!!! I’ve been laying low for over a year and have started using all of Amex cards we have in the last 6 months (previously was using primary only the Gold & Business Blue Plus). So a couple weeks ago, I attempted to apply for the Green (both for me and my wife) and we too got that dreaded popup! As a matter of fact, I’m been laying so low, I’m currently under 5/24 (only applied for business cards 24 months!). How long do you think people like us will be under Amex’s radar for?

@Ethan I’m sorry you’re having the same experience! I am currently at 3/24 and to be honest I am shocked that the pop-up box is still happening for me. I wish I could tell you when we will be free of this constraint. 🙁

I also get a lot of the AMEX popup – I think I’ve had most of the cards over the past 5 years. I think I still can get the personal Delta Reserve, but I’m at my 4 card limit for credit cards (Blue Business Plus, Hilton, Marriott, Delta Reserve Business, Amazon Prime business)- I know that’s 5 but I must be grandfathered in. I don’t want to give up any of these cards so I’m at an AMEX standstill. I have a personal Gold as well.

I don’t qualify for any additional Chase cards – I have IHG and Hyatt there. I recently got the Choice Rewards card (Barclays) and the Best Western card (First Bankcard). I read where US Bank is tightening their approvals as I would like the Radisson card, but I’m not going there.

At some point, you just have to use what you have and smartly earn as many points as you can.

You’re so right, use what you have and maximize the miles as best as you can. I still want some 50k bonuses though. 🙂