See our Advertiser Disclosure here.

As many of you know, this miles and points hobby isn’t rocket science. However, one of the keys to success is staying organized.

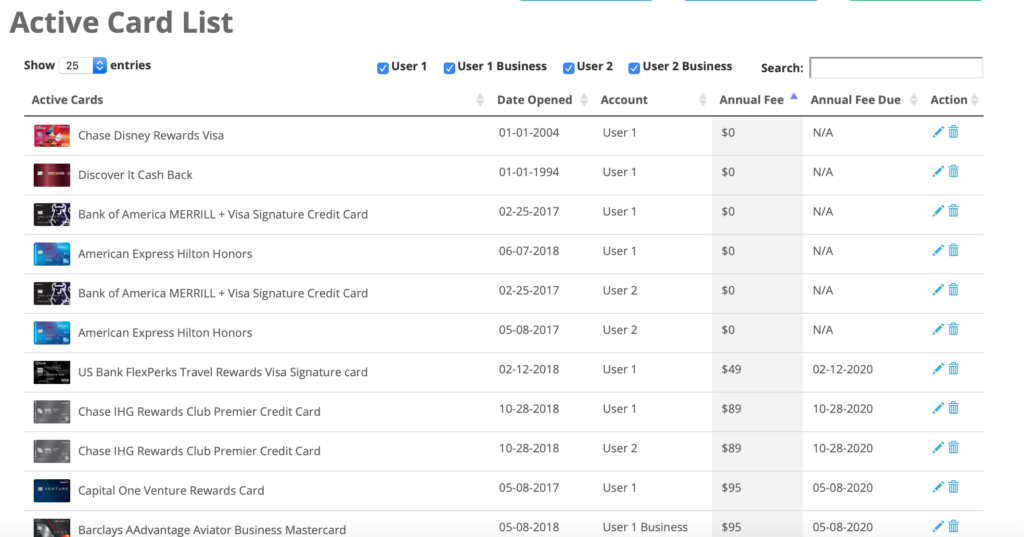

You’ve got to keep track of the dates you opened a credit card and the deadline for meeting spending thresholds to trigger sign-up bonuses. You also have to keep track of which cards have annual fees so that you can stay on top of paying the fee and/or decide if you want to keep the card before the fee hits.

If you don’t keep track of opening dates, you won’t know when you’re eligible to apply for new cards because of the 5/24 rule and other bank restrictions. When you don’t stay organized, you can’t maximize the benefits of this hobby.

Some people like to keep track of their cards in their heads (I don’t recommend), while others keep a hand-written log or use an Excel spreadsheet. Until a few months ago, I kept track of my cards on a simple spreadsheet. However, I’ve discovered a better way.

A few months ago, I had a FaceTime chat with Zac, the founder of Travel Freely. He told me about his tool that helps beginners learn about the miles and points hobby and helps existing hobbyists stay organized. I decided to try it for myself to see if it’s worth ditching my old spreadsheet. Spoiler alert: it’s better than my spreadsheet!

Staying Organized with Travel Freely

First of all, signing up for the Travel Freely tool is free. Also, you don’t enter in any credit card numbers, so you don’t have to worry about identify theft.

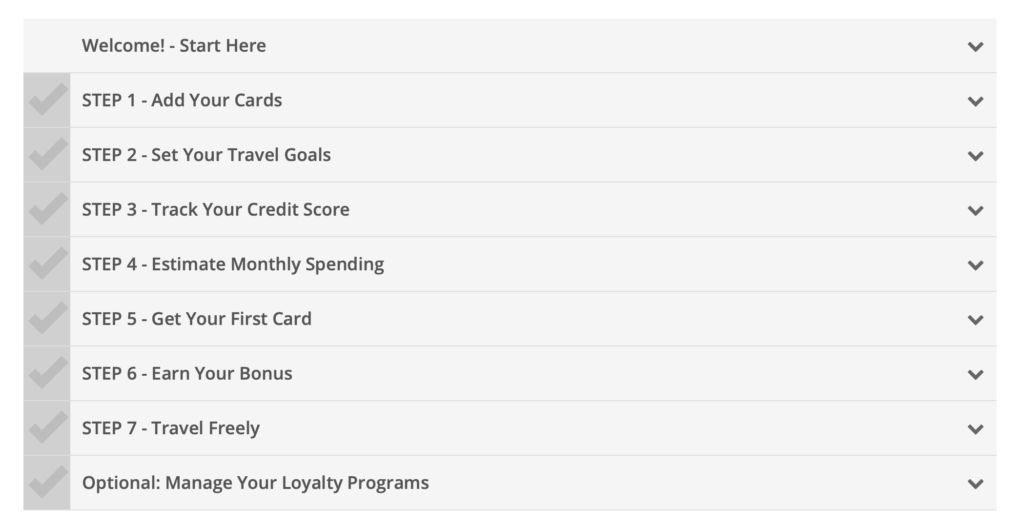

If you’re new to the miles and points hobby, you can follow a step-by-step process:

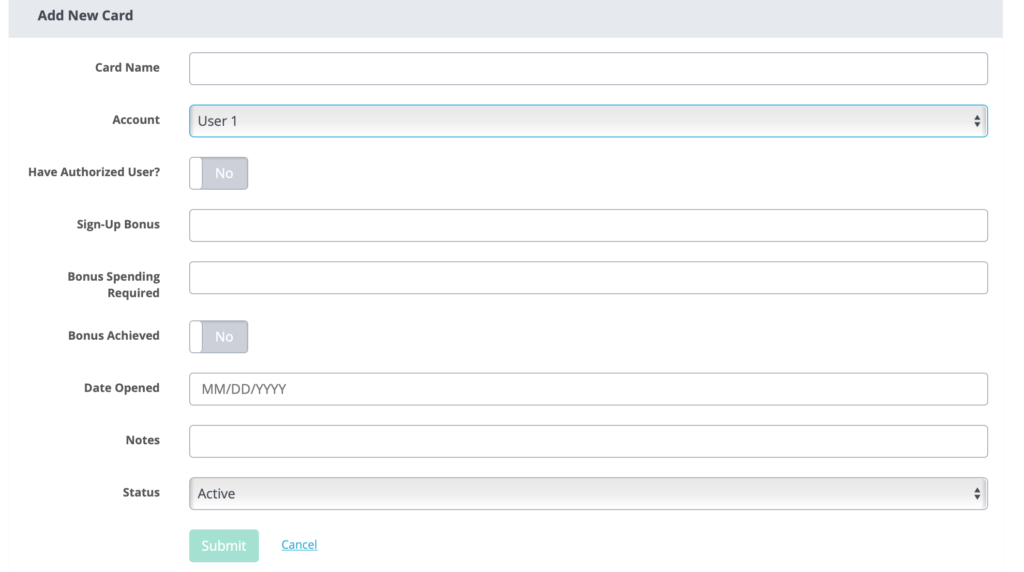

But, if you already know the basics of earning miles and points from credit cards, you can skip that and go right into entering your credit cards. You can keep track of two users and both personal and business credit cards.

For my active cards that are a few years old, I simply added the name of the card and the date I opened the account. If I opened cards in the past few years and already canceled them, I added those as well. This helps the tool know when I’m truly under 5/24 as well as when I’m eligible for other cards.

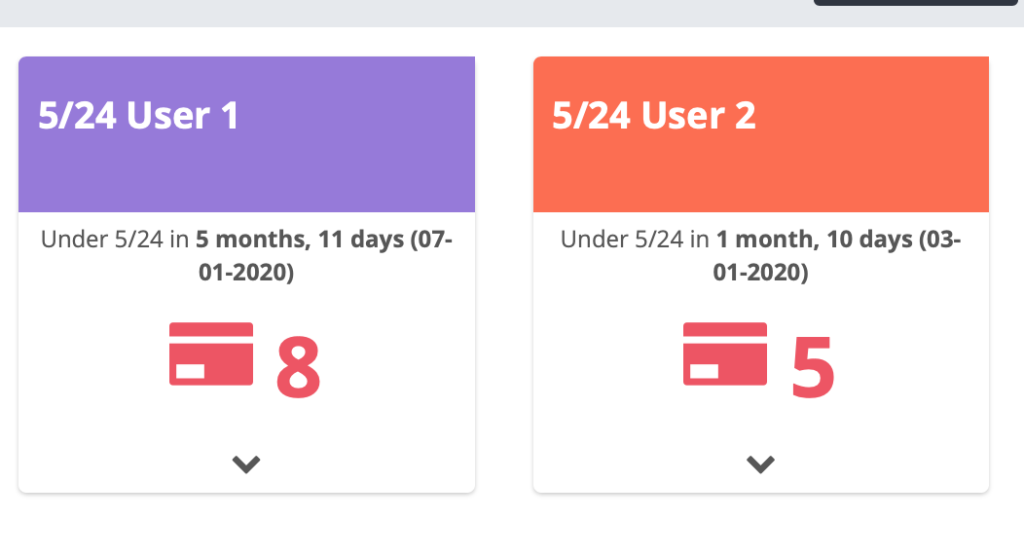

At the top of the Card Dashboard, I can see the dates when both my husband and I will be below the Chase 5/24 threshold.

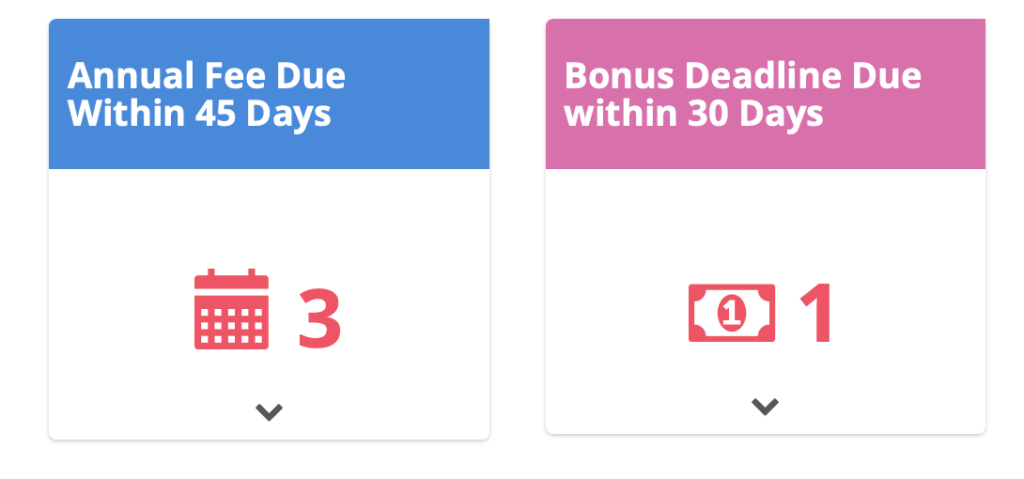

The tool also shows me if I have a card with a minimum spending due in the next 30 days as well as my cards with annual fees coming due soon.

Based on my past and current cards, the tool recommends new credit cards I may want to consider to help me with my travel goals. Travel Freely also has a plethora of resources for users who have questions:

Why I Like Travel Freely

- It’s Quick and Easy: Entering my credit cards didn’t take me much time at all. I’m not the savviest computer person, but I found the tool to be very easy and intuitive.

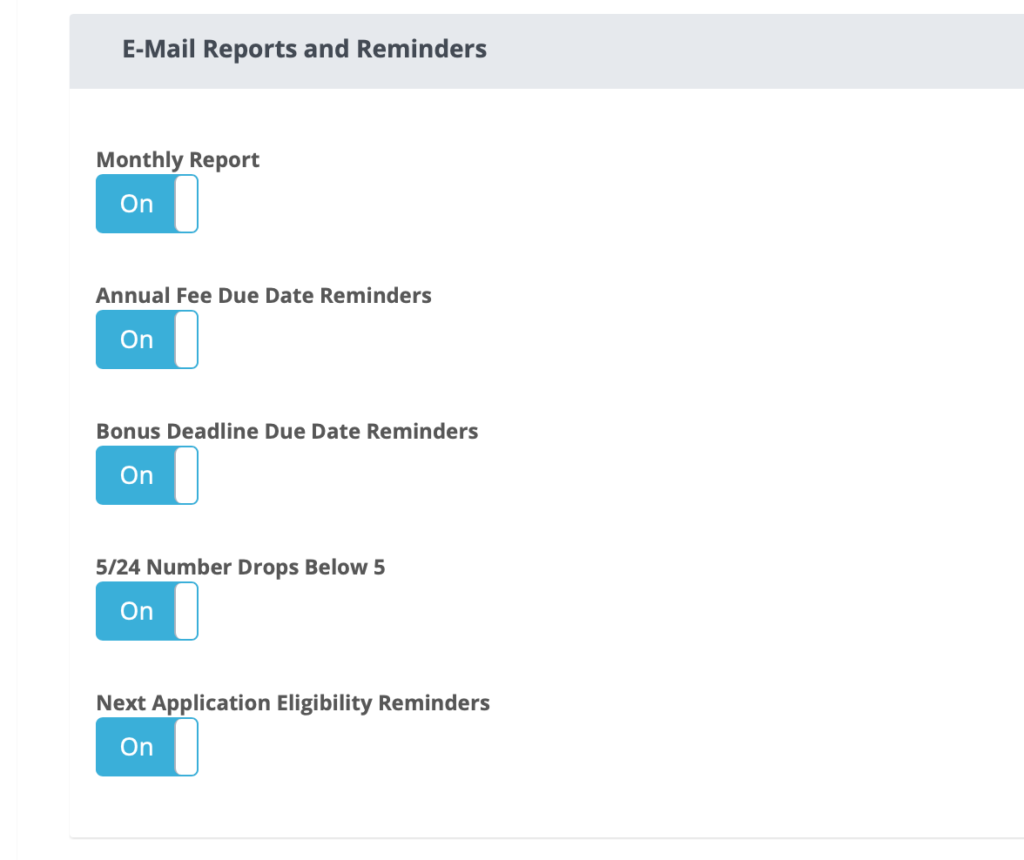

- I Get Email Reminders: Within the tool, I set up email reminders to alert me when my annual fees are coming due. Before this tool, I had to remember to look at my spreadsheet every month.

If you’re interested in Travel Freely, you can sign up for free here.

Readers, how do you stay organized with this hobby?

Disclaimer: Miles for Family is an affiliate of Travel Freely, and we receive a small commission when you sign up for the tool. Travel Freely makes money if you apply for a new credit card within the tool, which is totally optional. I tested this tool for two months prior to writing this post.

CLICK HERE TO VIEW VARIOUS CREDIT CARDS AND AVAILABLE SIGN-UP BONUSES

Opinions expressed here are author’s alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.

Author: Nancy

Nancy lives near Dallas, Texas, with her husband and three kids. Her favorite vacations include the beach, cruising and everything Disney.

[…] few weeks ago, my husband broke free from being under Chase’s 5/24 rule. Our handy online tool from Travel Freely reminded us that he is free to apply for a new Chase credit card without being rejected for the […]