Last year, I got the Amex Premier Rewards Gold card as part of my plan to earn points for flying my family to New Zealand. The card came with 50,000 Amex Membership Rewards points after spending $2000 in three months, annual fee waived the first year. And it served its purpose, as I transferred points to Aeroplan to book a one-way ticket on United from Auckland to Dallas.

But now, the card’s yearly fee of $195 is coming due (and next year it will have a $250 annual fee). I still have 30,000 MR points due to getting some referral bonuses (thank you to whoever you are!). I decided to cancel the card, so I need to find a home for my MR points.

Note for newbies: If you a cancel a credit card that has points specific to that bank (like Amex Membership Rewards or Chase Ultimate Rewards), you will lose your points after you cancel the card. If you cancel a co-branded card with airline or hotel points (like the Southwest Rapid Rewards card or the World of Hyatt card), your points will remain in your airline or hotel loyalty account after your cancel your card.

Options for Transferring and Keeping Amex MR Points

Amex Membership Rewards program has many transfer partners, including 18 airline partners. Airline transfer options include Avianca LifeMiles (a member of the Star Alliance, so you can book flights on United), Delta Airlines, British Airways (for booking flights on American Airlines), Hawaiian Airlines, JetBlue and more.

On the hotel side, you can transfer Amex MR points to Choice Privileges, Hilton Honors or Marriott Bonvoy. You can also redeem Membership Rewards points for gift cards to many retailers and travel companies including Walmart, Amtrak, movie theaters, Carnival Cruise Line and more.

If I had another credit card with Amex membership rewards, like the Amex Platinum card, I wouldn’t have to worry about losing my points or deciding where to transfer them. I could apply for another Amex card, like the Amex EveryDay Preferred. Or, I could downgrade my Amex Gold card to the Amex Green card that has a $95 annual fee.

British Airways Is the Winner

I only had to mull over my options for less than a minute to determine that the best choice for me is to transfer my Amex MR points to British Airways. My husband and I both accumulated British Airways Avios in the past through the Chase British Airways card. BA Avios were very useful to us to use on AA award flights since we fly out of an AA hub.

We used Avios to fly to Hawaii last year. We also used Avios to fly to Puerto Vallarta and Denver at just 7500 points per one-way ticket from DFW. My family has a household account so that we can easily combine our points for award bookings.

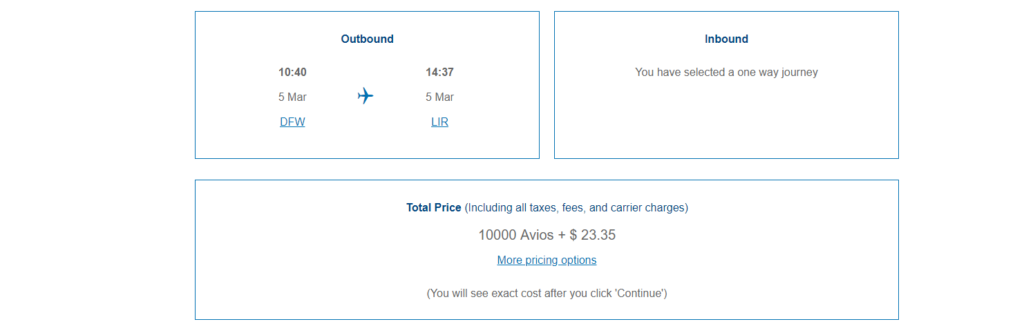

Next year for spring break, we are tentatively planning a trip to Costa Rica. Award flights on AA cost 15,000 miles. But, if we are lucky enough to find award availability on a direct flight, that same flight only costs 10,000 BA Avios:

Have you canceled an Amex Platinum or Amex Gold card after a year? Did you transfer your Amex MR points, or downgrade your card?

Click here to view various credit cards and available sign-up bonuses

Author: Nancy

Nancy lives near Dallas, Texas, with her husband and three kids. Her favorite vacations include the beach, cruising and everything Disney.

I’m only beginning to accumulate MR points, started last year with signing up with Amex rose gold.

The redemption I had in mind was for JetBlue flights to NYC in future years. But I would like to read more on the sweet spots/good redemption for MR points. I will look into the Avios redemption too for future flights to Hawaii. I just learned something new from this post about the household account.

We currently have the Southwest CP so we will be taking advantage of that until Dec 2020. Will be earning MR points in the meantime

@lea While I find Chase Ultimate Rewards to be the most useful, I have gotten a lot of good use from Amex MR points. You can transfer them to partners of the 3 big US airlines, which is how I was able to book a United flight without actually having United miles.

I got the Amex gold right before the refresh. I lucked out with my first year waived while still piling in the points. My family spends a ton on groceries, and earning 4 points per dollar makes the annual fee worth it. I also live with the option of using grub hub. We get take out once per week, and once a month- that’s our ticket for the $10.00 credit (and the airline credit for giftcards still seems to be working)I just make sure not to spend more than I would normally. It’s a forever keeper card for me! I do love following you and Leanna and am fascinated by your miles and points strategy (even though it is a bit different from mine)????. You also have much nicer readers! Makes a difference- I actually like reading your comments.

@Kelnland I agree that we seem to have nicer readers compared to other blogs! Not sure why that is, maybe because most have families? We don’t get the nonsense that seems to pollute comments sections of our hobby at times.

As far as Gold Card goes, like Nancy, I actually ended up canceling mine as well. I did keep it for over a year, so hopefully Amex doesn’t claw back the points. I debated on it because 4 points on groceries is useful to me. That said, I’m currently earning 6% cash back on my Blue Cash Preferred, so Gold would cannibalize that bonus category. I don’t do MS and it’s hard for me to utilize restaurant and food delivery perks. I do understand why this card is a keeper for some, and in your situation I would be tempted to hang on to it.

I would recommend keeping the card one more year. Plenty of datapoints out there of people who cancelled in the first year and had clawbacks, shutdowns, or now get the dreaded pop-up when trying to apply for another Amex card.

@projectx I am now safely past the 1-year point and can cancel within 30 days in order to not pay the big annual fee. You’re right, Amex would like me better if I kept the card for another year.

Same datapoints for what you plan on doing (shutdowns are rare though). It wasn’t that long ago this was perfectly safe and I’ve done just that. These days I won’t risk it.

You could open a Blue Business Plus card and keep the Membership Rewards flexible for no annual fee. I think that’s probably the best move.

@Nicholas I forgot about that one!