One or more of these credit card offers may no longer be available. See our Hot Deals page for the latest offers.

Over the years, I’ve seen a lot of people emphasize the valuation of points and miles. For example, an American Airlines mile is “worth” 1.4 cents to some folks. So if the miles cost of a ticket is 25,000 miles but the cash price is only $200 (or .08 cents per mile), you should just pay cash and save the miles for a more worthwhile ticket, right?

I’ve never bought into that logic completely. To me, if paying with miles is more financially feasible than taking money out of our savings account to pay in cash, I’ll pay with miles. After all, my goal with collecting miles and points via credit cards is to travel for free or at a greatly reduced price. The less cash I spend, the more I can travel.

Well, never say never. I’ve come across a situation where it makes no sense to use airline miles for flights.

The Math of Using Miles for Sydney to Auckland Tickets

For my family’s trip to Australia and New Zealand next summer, I’ve already secured flights from the U.S.A. to Australia on miles and flights home from New Zealand on miles. But, I’m still missing flights to get us from Australia to New Zealand in the middle of our trip. Since we are now done with our minimum spending on our new Hyatt credit cards, I decided it was time to look into a card that would help us get these flights for free or almost free.

The cash price of flying my family of five one way from Sydney to Auckland is anywhere from $550 (on a budget airline where seats and baggage are extra) to ~$700+ on a more traditional airline. That is the total amount for all 5 of us, not per person. I know that’s not a ton of money in the scheme of how much this trip would cost if we didn’t have miles and points, but it’s still a big chunk of change. Since I’m trying to pull off this trip down under as cheaply as possible, I figured it was worth looking into getting these flights on miles.

The best deal on miles is with British Airways Avios. Flights from Sydney to Auckland cost 10,000 Avios. Both my husband and I had the Chase British Airways card a few years ago and used our miles to fly to Mexico, Hawaii and Denver. But, it’s been over 24 months since my husband received the bonus, so he was eligible to apply for the card again.

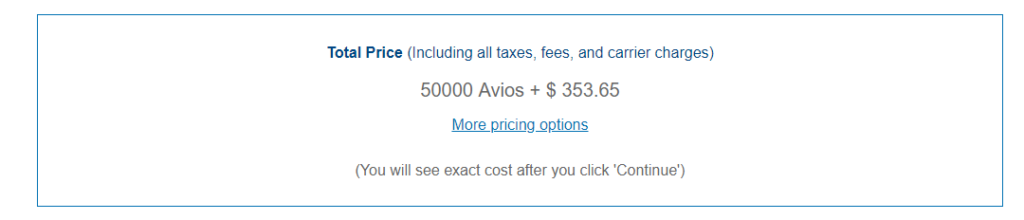

Before he applied, I checked online to make sure award flights were plentiful for our date. There was a lot of availability, but when I saw the taxes for our “free” flights, I had to stop the press:

$354 in taxes is a lot of cash to spend, plus the annual fee of $95 on the British Airways card is not waived. After some research, I discovered that the high cost is due to Australia’s Passenger Movement Charge. So if my husband got this card for the sole purpose of using the miles for our Sydney to Auckland tickets, we’d still have to spend $449 in cash between the taxes and the card’s annual fee. Since we could forgo using miles and just spend $700 cash or less on the flights, applying for the new credit card in this case would only give us an added value of $251 or even less.

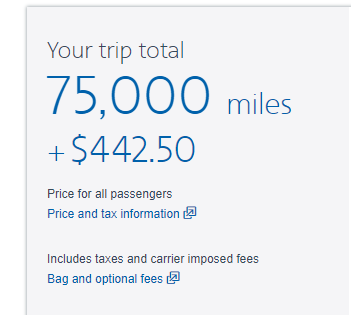

We have some AA miles we could use instead. Flights cost 15,000 miles each. However, the taxes and fees are even higher than with British Airways:

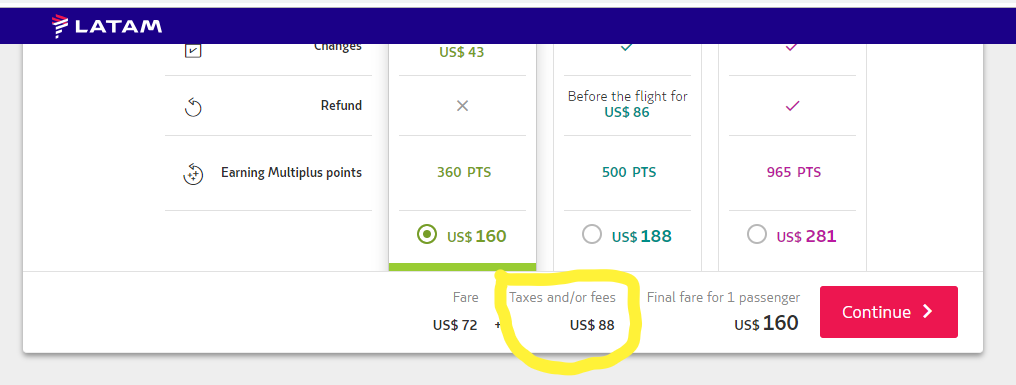

Were the airlines adding fuel charges to award tickets? Nope. I checked the cash price of a ticket through LATAM airlines, and sure enough, the taxes were a whopping $88 per adult.

I finally found my breaking point where using miles just doesn’t make any sense.

Alternative to Using Airline Miles

This is the perfect example of when it makes more sense to use a card with cash back or travel reimbursement points. That way, we don’t have to fork out both miles and a high amount of cash.

If my husband applied for the Barclaycard Arrival Plus, we would have over $600 to use towards the flights. Or, one or both of us could apply for the Capital One Savor card, which gives a $500 cashback bonus after spending $3000 in the first three months. The annual fee is waived the first year on both of these cards.

Another more sensible alternative is to use the $300 annual travel reimbursement from my husband’s existing Chase Sapphire Reserve card combined with some Chase Ultimate Rewards points to buy the flights through Chase’s travel portal.

Another Option for Optimizing Miles and Points on this Trip

Instead of focusing on getting our flights from Australia to New Zealand free, we decided to focus on another aspect of our trip: lodging in Sydney.

Hotels in Sydney are expensive. Since we will only be there a short time and it’s unlikely we will visit Australia often, I don’t want to cheap out on our accommodations. I want to stay in the central business district so that we are within walking distance of many attractions instead of staying in the suburbs. We need to stay in a place that has a front desk open 24/7 since our flight arrives early in the morning. I don’t want to stay in a dormitory-style hotel with a bathroom down the hall when we are dealing with jetlag.

With those requirements, our lodging in Sydney will cost us at least $1000-$1200 for three nights for my family of five. Ouch!

Enter the Chase IHG Rewards Club Premier Credit Card. My husband and I have never had the IHG credit card before, if you can believe it. We both applied through a non-affiliate link (that has since expired) that offered 100,000 bonus points, 5000 points for adding an authorized user and a $50 statement credit. The $89 annual fee is not waived the first year, but with the $50 statement credit the card costs us just $39 X 2 or $78 total for over 200,000 IHG points.

Once we add each other as authorized users and put just a few months spending on the card, we will have enough IHG points to cover our lodging in Sydney. We are eyeing the Holiday Inn Old Sydney Hotel and the Holiday Inn Darling Harbour. The cash price for my family of 5 at these hotels is about $1700. So, paying $78 to open the credit cards and using points is a great value.

Bottom Line

After doing the math, using miles for flights isn’t always the best choice. In my case, we get much more bang for our buck if we pay for our flights in cash and apply for a hotel credit card to cover lodging.

Traveling to Australia and New Zealand is an amazing opportunity. We wouldn’t be going without the help of miles and points from credit card bonuses.

Do you pay attention to the value of your miles and points currencies? Do you have a minimum required value to spend your miles/points? Or, do you use them if it will save you a significant amount of cash no matter the cents per point on your redemptions?

Click here to view various credit cards and available sign-up bonuses

Author: Nancy

Nancy lives near Dallas, Texas, with her husband and three kids. Her favorite vacations include the beach, cruising and everything Disney.

Hey, I’m pretty sure that photo was taken in Hobbiton, which is in Matamata. Waitomo is a separate village. I think…?

As for miles, I usually try to save my miles for decent redemption value. But this can depend on variables such as how much money I have at the moment and how important the trip is.

@Talchinsky It sure does look like Hobbiton! There is a look-alike hotel in Waitomo, so maybe that’s where the photographer was? Wherever it is, I want to go!

Well done! You made the right choice for sure. I love seeing the puzzle pieces come together. A bonus, the IHG annual nights ought to make this a decent keeper card for you.

@Kacie Thanks. I just hope those hotels still have availability on points by the time we get our spending done. Not sure if the card will be a keeper for us or not yet.

I would totally hold on to my miles under those circumstances! I’m all about free-ish travel, but the math simply doesn’t add up here. Looking forward to your article on using miles to Australia and back.

@Leana I’ll definitely be writing a post about all the cards, miles and points that went into our tickets down under. 🙂