Because I participate in this miles and points hobby and write about it for Miles For Family, I am constantly reading about credit card offers online. The amount of info out there about credit cards is overwhelming! My Twitter feed, various blogs I read and discussion forums keep me busy reading about offers. And, the top offers are constantly changing.

However, I realize that most normal people don’t spend this much time online reading about the best credit cards. Who has time for that? Most people get info about new credit cards through snail mail pre-approvals and advertisements.

According to recent data, credit card companies mail out ~4 billion pieces of mail per year in the U.S. to advertise their credit card products. I get so much of this “junk” mail in my mailbox each week! See this Federal Trade Commission article for information about how these pre-screened offers get to your home, and check out this post by Doctor of Credit for instructions on how to opt in.

Why would anyone want to opt in to junk mail? Well, it’s not all junk. Sometimes, these targeted credit card mailers are better offers than what is available to the general public online. I see examples of this on reddit and Flyertalk all the time, like this example of a targeted mailer with a bonus offer that is double the current public offer.

So, if you are inundated with snail mail offers and are considering applying for a new credit card, how do you determine which are the best credit card offers?

Determine your goal(s)

Before you apply for a new credit card, think about what you are trying to accomplish with a new card. Is your goal to use miles to fly on vacation? Do you want to accumulate hotel points to pay for a trip you already have planned? Do you want to earn cash back that you can spend on home improvements or other non-travel things? Or, do you need a card with an extended 0% APR?

Always have your goal in mind when evaluating a new credit card offer. Because even if the offer is incredible, if it doesn’t get you closer to your goal, what’s the point?

Check for partners and alliances

Before you throw away an offer that doesn’t appear to align with your goals, make sure there’s really not a way to use it to get closer to your goal. There are so many airline alliances and partners that it can be difficult to know if the offer is really useful or not.

For example, say you live in an American Airlines hub city and you’re trying to accumulate more AA miles. You receive an offer for a British Airways credit card and assume it won’t be useful. However, British Airways Avios can actually be used to book flights on AA and Alaska. Don’t throw that offer away!

Card with flexible points can be especially deceiving. American Express Membership Rewards, Chase Ultimate Rewards, Citi ThankYou points and even SPG points have dozens of airline and hotel partners. All of these could help you get closer to your goal.

Keeping track of all of the airline and hotel alliances and transfer partners is difficult. Here are some resources to help:

- Airline alliance Wikipedia page

- Airline partner list

- Amex Membership Rewards Transfer Partners

- Chase Ultimate Rewards Transfer Partners

- Citi ThankYou Points Transfer Partners

Read the fine print

It’s important to read the details of all credit card offers (both online and snail mail offers). Some use big numbers to draw you in, but once you see the details, the offer is not as impressive.

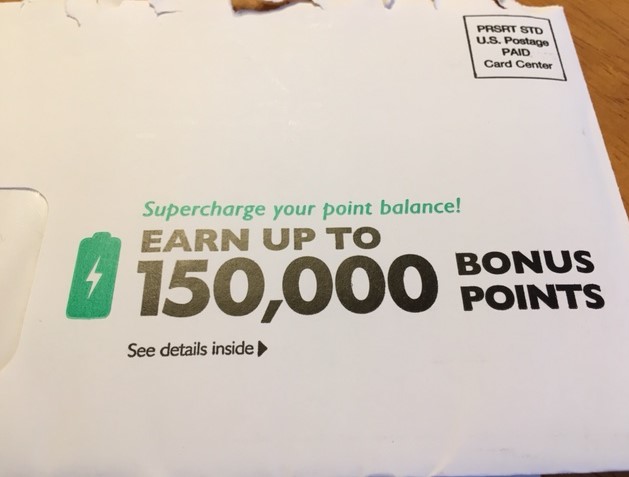

For example, my husband recently received this offer for the Chase Marriott Rewards card. 150,000 points sure caught our attention! The normal bonus is 80,000 points. I was ecstatic because I thought my husband received a targeted bonus of 150,000 Marriott points.

However, once I dug into the offer, my elation disappeared. There were no bonus points. The card offered 5X points on all spending up to $30,000 in the first year, thus making it possible to earn 150,000 points. Ugh! $30,000 is a lot to charge in one year, and we could turn that kind of spending into more valuable points with different credit cards.

Also, look for language in the Terms and Conditions that might disqualify you from the bonus if you have had the card recently or any time in the past. Amex cards might say “Welcome bonus offer not available to applicants who have or have had this product.” Chase cards frequently say “This product is available to you if you don’t have this card and have not received a new card member bonus for this card in the past 24 months.” Citi cards may say “Bonus points are not available if you have had these cards opened or closed in the past 24 months.”

Banks do sometimes send out targeted offers without these requirements, so don’t discard an offer automatically if you have had it in the past.

Make sure it’s the best offer available

If you have determined that a new card has rewards that meet your goal and you have read the fine print, make sure you are getting the best possible bonus offer on that card before you apply. Which is easier said than done!

Unless you read blogs, reddit and Flyertalk daily, you might not know if your snail mail offer is the best available. Better offers may come from current card owner referrals, online incognito offers or tools like CardMatch. So, do you have to spend hours Googling this info?

No! Just ask us. Seriously, send us an email at milesforfamily@gmail.com or submit a question through the blog. You can also reach out to us on Twitter or Facebook.

Sometimes, the best offer is through the affiliate links on our blog, but not always. If we know of a better offer, we will tell you. We would rather forgo commission on a credit card in order to keep you as a long-term reader. We’re in this for the long haul, not just for today’s profit.

Bottom Line

Wading through all the snail mail (and online) credit card offers can be tricky. Keep your goal in mind, and pay attention to partners and the fine print. Once you decide to apply for a card, make sure you are applying with the highest offer for that card to maximize your rewards.

Readers, have you applied for a credit card through a snail mail offer recently?

Click here to view various credit cards and available sign-up bonuses

Author: Nancy

Nancy lives near Dallas, Texas, with her husband and three kids. Her favorite vacations include the beach, cruising and everything Disney.

Leave a Reply