Note: Some of the offers below are no longer available. See our Hot Deals page for the latest offers.

Unlike the author and radio host Dave Ramsey, I don’t think credit cards are evil. Obviously, since I work for a site that promotes travel with points and miles earned from credit cards!

Credit cards that earn miles and points are useful tools for traveling for free or at a reduced cost. The key, of course, is to pay off your balances every month so that you don’t pay interest and fees.

In addition to traditional miles and points credit cards, credit cards with 0% APR can also be useful tools for travel. While using miles and points to pay for a trip is ideal, it’s not always possible in every circumstance. A 0% APR card is like having an interest-free loan that buys you more time.

My family has a big vacation payoff deadline in about three weeks. Even though our trip isn’t until the summer, Disney Cruise Line requires full payment four months ahead of time.

While we actually have money in our emergency fund to cover the balance, we are considering using a 0% APR card to pay off our balance by our due date and saving our emergency fund for a true emergency. This would allow us time to get our tax refund and a potential work bonus, which we would then use to pay off our credit card balance at a later date. I would not use a 0% APR card for just any trip, though.

Trips when I would consider using a 0% APR card

- The Big One. This is the trip you’ve been saving for and planning for years. For me, it’s our upcoming Disney Cruise to Alaska.

- Unique and One-Time Events. Events like the Super Bowl and the Olympics don’t happen every day. If you get the chance to go last minute, or even if you know well in advance, it can be difficult to find award availability surrounding these popular events. We are planning on traveling to the 2020 Olympics, and you can bet that I will use a 0% APR card if needed.

- Family Events. Sometimes we don’t choose the dates of weddings and family reunions, but these are the most important trips we take. If your best friend or brother is getting married in Hawaii and you don’t have the miles or award availability, a 0% APR card comes in handy.

- Unexpected Trips. When you have to travel for a family member’s surgery or funeral, using a 0% APR can help spread out the cost.

Where to find 0% APR credit cards

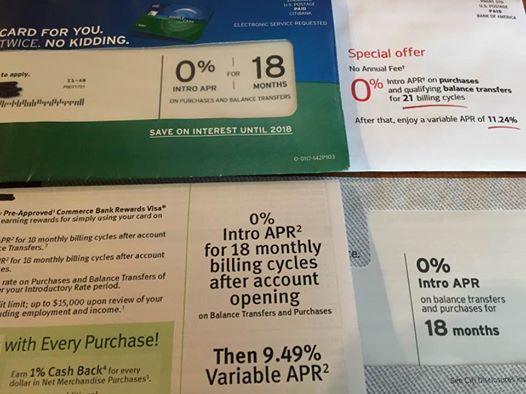

• Snail mail offers. I get a few of these in the mail every week! You can also check special section devoted to 0% APR offers on any site that markets credit cards.

Cards with rewards AND 0%?

Yes, it’s possible to find a credit card that offers cash back, miles or points in addition to a great introductory 0% APR. For example, the Citi Double Cash card offers 2% cash back (1% for purchases and 1% when you pay your bill). It currently also comes with 0% APR on purchases for 18 months.

The Discover It card is another card that effectively has 2% cash back during the first year in addition to 14 months 0% APR. You can earn up to 5% in categories that rotate each quarter, and Discover doubles your cash back at the end of your first 12 months with a Cashback Match. If you apply through a referral, you get a $50 bonus after charging your first purchase in the first three months.

Capital One VentureOne Rewards card currently offers 0% APR for 12 months as well as a 20,000 mile sign-up bonus after spending $1000 in the first three months. The Blue Cash Everyday card from Amex comes with a $100 bonus after spending $1000 in the first three months and earns 3% cash back at supermarkets. Be aware, there are better targeted offers available now and again. All of these cards earn either cash back or miles and come with no annual fee. Some pay us commission if you apply through this site.

For our upcoming trip, we will likely use a 0% benefit from one of our existing credit cards. Our Chase Disney Visa offers six months no interest for Disney vacation packages, and a Disney cruise falls into that category. We will get 0% APR while earning Disney Reward Dollars for the portion we charge on the card.

Using 0% APR cards responsibly

• Take detailed notes of when your card’s 0% APR promotion ends.

• Make the required monthly minimum payments, and pay well before the due date. Late fees negate the value of a 0% APR card, and you may end up paying a high interest rate if you miss a payment.

• Only charge amounts on the card that you reasonably sure you can pay off during the promotional period.

• Pay more than the minimum payment to pay off your balance sooner than required.

• Don’t make a habit of charging every trip with a 0% APR card. Use this tool as an exception, and focus on using cash or miles and points for most trips.

• Read the fine print on 0% offers on balance transfers. Most come with a balance transfer fee.

For my family, credit cards that have high miles and points sign-up bonuses are my first priority. However, I won’t rule out 0% APR cards for the right circumstances. I look at all of these cards as tools that can help me travel cheaper or faster.

Do you use 0% APR credit cards for travel or other reasons?

Click here to view various credit cards and available sign-up bonuses

Author: Nancy

Nancy lives near Dallas, Texas, with her husband and three kids. Her favorite vacations include the beach, cruising and everything Disney.

One of the tricks is that the balance transfer fee usually is categorized as a purchase and therefore DOES accrue interest. So you have to make sure to immediately pay the minimum payment PLUS at least the amount of the fee, as any payment above the minimum is allocated to the highest APR. Likewise, after you’ve transferred a balance don’t also use the card for purchases (unless purchases are also at 0%).

Always get an exact end date to the promo rate in writing, like by secure message. This is another tricky area, as the promo may end at the close of the billing cycle, leaving a nice gap until the due date.

Also, depending on the length you will carry the balance, it may be better to select an offer with a low APR (like 4.99) and no transfer fee. Such offers are less common but are occasionally an option (usually there are a couple of choices). Always consider your situation and do the math accordingly.

Great advice, Audrey! I haven’t done a balance transfer in a long time. I’m hoping to just stick to new purchases on 0% APR cards, or not even that if I can help it.

How many Disney dollars do you expect to earn from the charged portion? I always laugh at how much I think my bill will be at the end of the cruise with tips, drinks, excursions, etc. and it’s always 10X’s more than what I was expecting. Great article, and yes, I don’t agree with Dave Ramsey on his credit card hatred either.

@Stephanie I’m hoping I don’t have to charge too much to my Disney card on the payoff date, so not more than $10 or so in Disney Reward Dollars. Still, I’ll take it! 🙂 I’ve always underestimated what I spend on-board as well. I think our last cruise was the first time predicted just the right amount.

Great idea. I always wondered where the 0% APR cards fit into this hobby, and this is a great idea. Thanks for sharing.

@Lisa Thanks! The 0% cards are not as exciting as others, but still very useful in certain situations.