Last month, we had a surprise mini windfall. My husband received an email from his work that his referral bonus for referring a new hire would be in his next paycheck.

The email surprised us because we both forgot about the bonus, and the bonus turned out to be 3X the amount we expected. Woohoo!

Ideas for the Windfall

My husband texted me from work to share the good news. Of course, my mind immediately went to travel. We could almost pay off the rest of our Disney Cruise to Alaska and be done with it! Paid off three months before the deadline!

My husband’s mind went somewhere else: home improvements. He proposed that we could update our living room furniture.

We purchased our sofas almost 13 years ago, and we can best describe them as looking “well loved.” The leather was worn down so much in some sections that it appeared the sofas had large stains, although that wasn’t the case. They were just really worn down (mostly from our dogs).

Our coffee table was also an eyesore. We purchased it right before we brought our second son home. Since he was already toddling around, we got rid of our old square, full-of-potential-injury coffee table in favor of this round, faux-leather table. But now, the faux-leather was peeling off and the table was barely still standing.

(Reminded me of Leana’s recliner).

(Reminded me of Leana’s recliner).

My husband also wanted to replace the two end tables that he has owned for about 20 years. They are in good shape, but he’s sick of looking at them. In addition, he wanted to get a nice TV stand, since our TV set-up reminded us of a college dorm. Basically, he wanted to change out our whole living room.

Husband vs. Wife

The fact that my husband and I had drastically different ideas on what to do with this small windfall was no surprise. We have been wrestling with this our whole marriage.

My husband loves our family vacations. He just doesn’t like to plan them or know how much they cost. (Thank goodness for miles and points, right?!)

He is a “my home is my castle” type person. Since we spend over 90% of our year at home, he thinks that investing in making our home more attractive and comfortable makes sense.

I don’t disagree with that logic. In fact, when I watch HGTV (which is nearly every day), I start longing for “updated spaces” and a “backyard oasis.” We both agree that we’d like to put an outdoor living space in our back yard. We’d love to extend the patio and roof, add misters, outdoor furniture and install a hot tub for me!

We’d also like to convert an upstairs hallway walk-in closet to a bathroom so that we have two bathrooms for our three kids to use. We had no idea when we bought this house of the shouting matches that would ensue from three kids trying to get ready for school in the same bathroom.

But if it were up to me, we would live in a van down by the river and spend more money on traveling. My travel wish list is long and always growing. I mentioned a few places in a recent post, but in reality my list of vacation ideas is much longer.

The Compromise

So what did we do?

After much friendly debate (no really, it was quite friendly), we decided to split the money. We allocated two-thirds of it for the living room and one-third for our Alaska cruise.

My husband and I ended up buying a new sofa sectional with an ottoman that will double as our coffee table. We also purchased a new TV stand, but we had to forgo new end tables and the recliner that matched the sectional. If we didn’t use some of this unexpected money for a new sofa, we might not ever get one.

My husband will have to look at those end tables for a few more months years. Sorry, honey.

I’m glad that my husband and I balance each other out. We can keep our home looking halfway decent (but not spectacular) and also travel with our kids.

Progress on Paying Off Disney Cruise to Alaska

On a related note, we now have about 2 ½ months before our final payment is due on our Disney Cruise to Alaska. According to my detailed spreadsheet, we are 60% paid.

I’d like to be closer, but we spent more money on excursions in Mexico than we had originally planned. I have no regrets, because adding in the excursion to Las Caletas was definitely the right call. We also ran into some unexpected healthcare expenses that really added up.

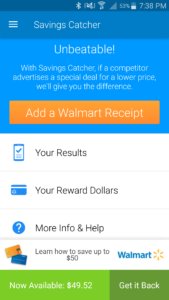

I’ve been uploading my Walmart receipts religiously into the online Savings Catcher. It’s time to cash in my balance for another $50 Disney gift card. Every little bit helps!

As a family, we decided to have a “no-spend” January. We have done this in the past to save up for a big vacation or a big ticket item. Essentially, we will only spend money on gas and groceries for the month. No going out to eat, no trips to the movies, no new clothes, etc. Not only will we be able to save up more money for our cruise, but our kids will understand that we all have to make some sacrifices to reach a big goal. We can’t just snap our fingers and magically have enough money for a Disney cruise.

As a family, we decided to have a “no-spend” January. We have done this in the past to save up for a big vacation or a big ticket item. Essentially, we will only spend money on gas and groceries for the month. No going out to eat, no trips to the movies, no new clothes, etc. Not only will we be able to save up more money for our cruise, but our kids will understand that we all have to make some sacrifices to reach a big goal. We can’t just snap our fingers and magically have enough money for a Disney cruise.

I’m projecting that we will be ~80% paid off by the deadline. We will pay the remaining 20% either with my husband’s work bonus (which is uncertain) or by taking advantage of the 6-months 0% interest benefit of my Chase Disney Visa.

Is your family on the same page about spending money on vacations vs. home improvements? How do you strike a balance? Do you ever have a “no-spend” month to save up for something big?

Click here to view various credit cards and available sign-up bonuses

Author: Nancy

Nancy lives near Dallas, Texas, with her husband and three kids. Her favorite vacations include the beach, cruising and everything Disney.

Did you get the “20% rebate ($250 max) at Sams Club” offer on any of your Amex cards? Sam’s sells Disney gift cards and you can load up. We had to buy some stuff at Sam’s and ended up getting several GCs due to the rebate (which posted within 24 hours). Easily covered the AF and more for that Amex card. Note: The Amex Sam’s offer only works for in-store purchase – online purchases will not trigger the offer.

Darn it, we didn’t get that offer on our cards. Glad you were able to buy some gift cards with it!

Just saw this timely post from Shawn’s blog about alternative ways to load the offer on your Amex card. http://milestomemories.boardingarea.com/sams-club-amex-offer-targeting

Thank you, Erik! I’ll try both of those and report back.

Bummer, these methods didn’t work for me or my husband, hopefully others will have luck! 🙂

I think y’all made a good call on the furniture! It was definitely time. Haha. I know the struggle. Our home could really use painting, but trips seem to come first. Maybe next year, it’ll happen.

I promised my husband we’d paint our main living area early next year. We’ve been putting it off for years! I’m sure I’ll love it when it’s done, I just have a hard time putting so much money into the house vs. travel.

We just started getting new furniture because the kids are no longer trying to destroy stuff around the house. Well, not the way they used to! I can’t wait to get rid of my dining room set, but we have too many trips to save for. Maybe next year…

I’m not sure my kids are done destroying our furniture. I’m still afraid to get a new dining room table.

Love the new sofa and ottoman

Thanks, Hilary!